The fintech industry is rapidly evolving and disrupting traditional financial systems. In this article, we bring you the latest research insights to help you stay ahead of the curve and understand the future of financial technology. Enjoy researching!

EBA consults on draft technical standards on complaints handling procedures under the Markets in Crypto-Assets Regulation (EBA)

The European Banking Authority (EBA) published today a Consultation Paper on draft regulatory technical standards (RTS) on complaints handling procedures for issuers of asset-referenced tokens (ARTs) under the Markets in Crypto-Assets Regulation (MiCAR). These draft RTS aim at ensuring prompt, fair and consistent handling of complaints by holders of ARTs and other interested parties.

The EBA is mandated to develop, in close cooperation with the European Securities and Market Authority (ESMA), draft RTS on the complaints handling procedures of issuers of ARTs. The RTS must further specify the requirements, templates and procedures for handling complaints received from holders of ARTs and other interested parties, (including consumer associations that represent those holders), and procedures to facilitate the handling of complaints between holders of ARTs and third-party entities, where applicable. Read more

Powering ahead: Shaping the future of electric vehicles (Mastercard)

Driving an electric vehicle is part of my everyday life. I live in Belgium, and it has been encouraging to see a gradually increasing presence of EVs on our roads in recent years. The average greenhouse gas emissions of EVs are between 17% and 30% lower than the emissions of petrol and diesel cars, according to the European Environment Agency. Their potential to drive Europe’s net zero journey forward is indisputable.

But while automotive innovation continues to attract more Europeans to EVs, there remains a significant hurdle to mass adoption: charging. Read more

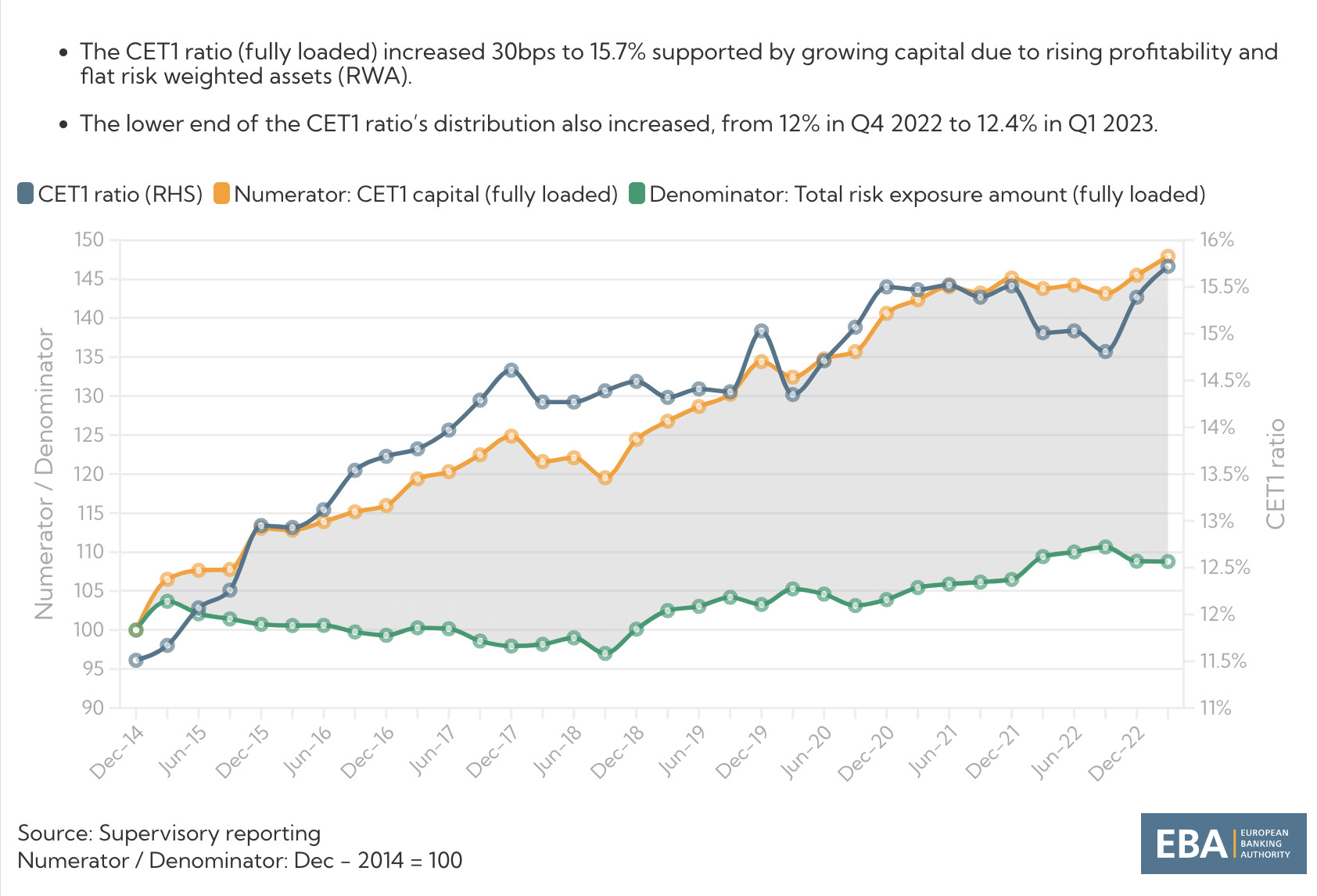

EU/EEA banking sector shows rising profitability, but asset quality and profitability related risks are looming (EBA)

The European Banking Authority (EBA) today published its Q1 2023 quarterly Risk Dashboard (RDB). The publication presents the results of the EBA’s latest risk assessment questionnaire (RAQ), which was conducted among 85 banks in spring this year. It also includes information on minimum requirement for own funds and eligible liabilities (MREL). Banks’ profitability continued to increase, and their capital, funding and liquidity ratios remain strong. Bank debt issuance has resumed after a temporary halt due to the Silicon Valley Bank (SVB) and Credit Suisse (CS) induced turmoil. A downward trend in liquidity and funding ratios is expected due to repayments of the ECB’s targeted longer-term refinancing operations (TLTRO). Read more

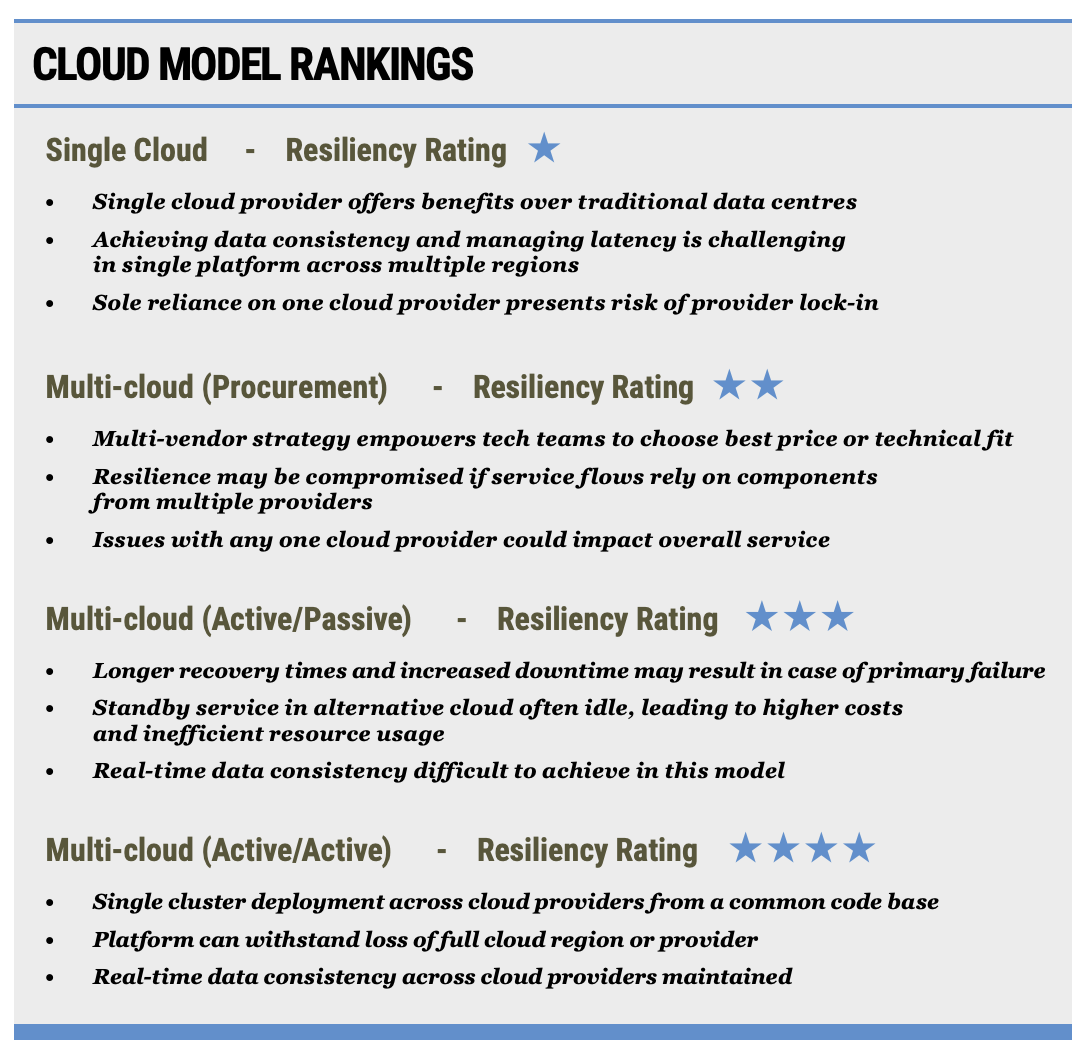

From Cloud to Multicloud, Pathway to Resilience (Finextra)

The term “multicloud” has various interpretations, each offering different levels of resilience and reliability for bank payment platforms. Financial institutions may believe they have implemented a true multicloud model, but discrepancies in definitions can lead to confusion. This summary compares four cloud approaches—Single Cloud, Multi-cloud (procurement), Multi-cloud - Active/Passive, and Multi-cloud - Active/Active—to clarify the differences and determine the most resilient and reliable options for financial institutions in their journey to the cloud. Read more

Report: The case for open source database software in finance – key drivers and strategies for adoption (Fintech Futures)

Report: The case for open source database software in finance – key drivers and strategies for adoption (Fintech Futures)

Financial services firms face a multitude of challenges, with new ones coming on top of long-standing ones. Competition and customer expectations are increasing, at the same time as firms need to adhere to strict regulatory and security standards. In parallel, there is the need to modernise legacy systems and reduce infrastructure costs while accelerating time-to-market. It is essential to ensure 24/7 availability and optimal application performance. Read more

–

Do you have any news to share: please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion