The fintech industry is rapidly evolving and disrupting traditional financial systems. In this article, we bring you the latest research insights to help you stay ahead of the curve and understand the future of financial technology. Enjoy researching!

Case Study: How Takeda harnessed the power of the metaverse for positive human impact (EY)

A leader in innovation and cutting-edge science, Takeda is in the top 15 pharma companies globally by revenue. The company has an ambition to become the world’s most trusted, science-driven pharmaceutical company and chose the EY organization to work closely with across the breadth of its digital transformation. The ultimate goal is to unleash the power of digital technologies and data to meet the evolving needs of its patients. Takeda built an innovation hub to introduce digital solutions, artificial intelligence, robotics, automation and analytics to the business, and as the next step in this venture was interested in the metaverse. Takeda’s Chief Technology Officer, Leo Barella, first experienced the metaverse at EY wavespace™, which is a collaboration solution, and asked how to explore the business potential of the metaverse for Takeda and its industry. Read more

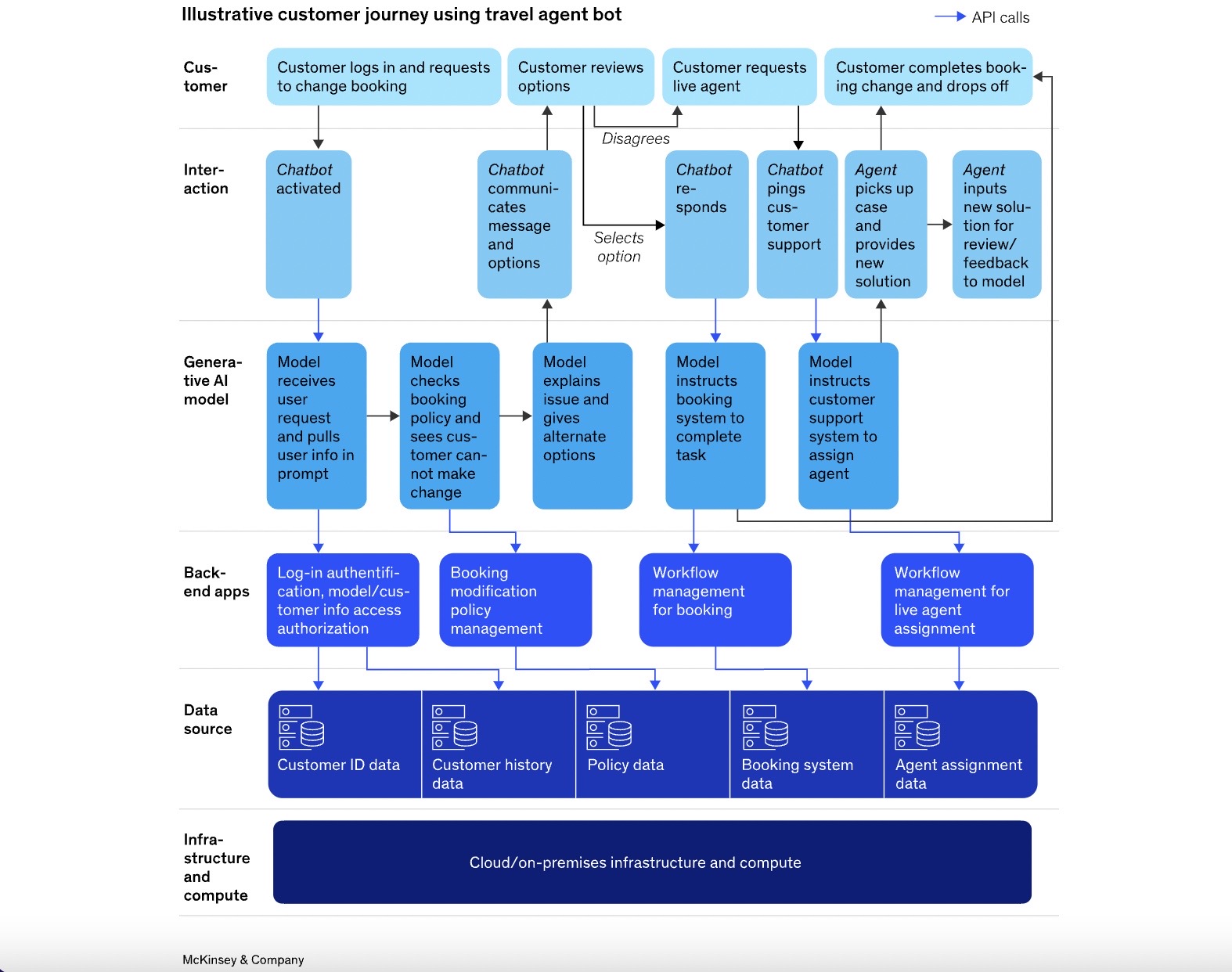

Technology’s generational moment with generative AI: A CIO and CTO guide (McKinsey)

Hardly a day goes by without some new business-busting development related to generative AI surfacing in the media. The excitement is well deserved—McKinsey research estimates that generative AI could add the equivalent of $2.6 trillion to $4.4 trillion of value annually. Read more

Long-Term Success of Virtual Banks Hinges on Ability to Leverage AI, Data Analytics (Fintech News)

Neobanks are proliferating around the world on the back of strong trends including technological advancements, regulatory changes and evolving customer expectations. And yet, despite the favorable market conditions, many are still struggling to turn a profit. For neobanks to be successful in the long run, these companies will need to embrace an artificial intelligence (AI)-powered banking model, a report by global consulting firm McKinsey and Company says. Titled “Building a Winning AI Neobank”, the report discusses the rise of neobanks and explores how launching a successful neobank in today’s uncertain environment requires firms to target specific characteristics and capabilities in their strategy and execution plans, suggesting that incorporating AI technology can increase the odds of success. Read more

Using a Digital Literacy Toolkit to Narrow the Digital Skills Gap for Women and Smallholder Farmers in Uganda (Impact Capital for Development)

The use of mobile money to carry out day to day transactions is now commonplace for most Ugandans. Mobile money presents an opportunity for social impact by enabling different groups such as women, youth, and refugees to access services which can help them to manage their daily lives and improve their livelihoods and financial health. Read more

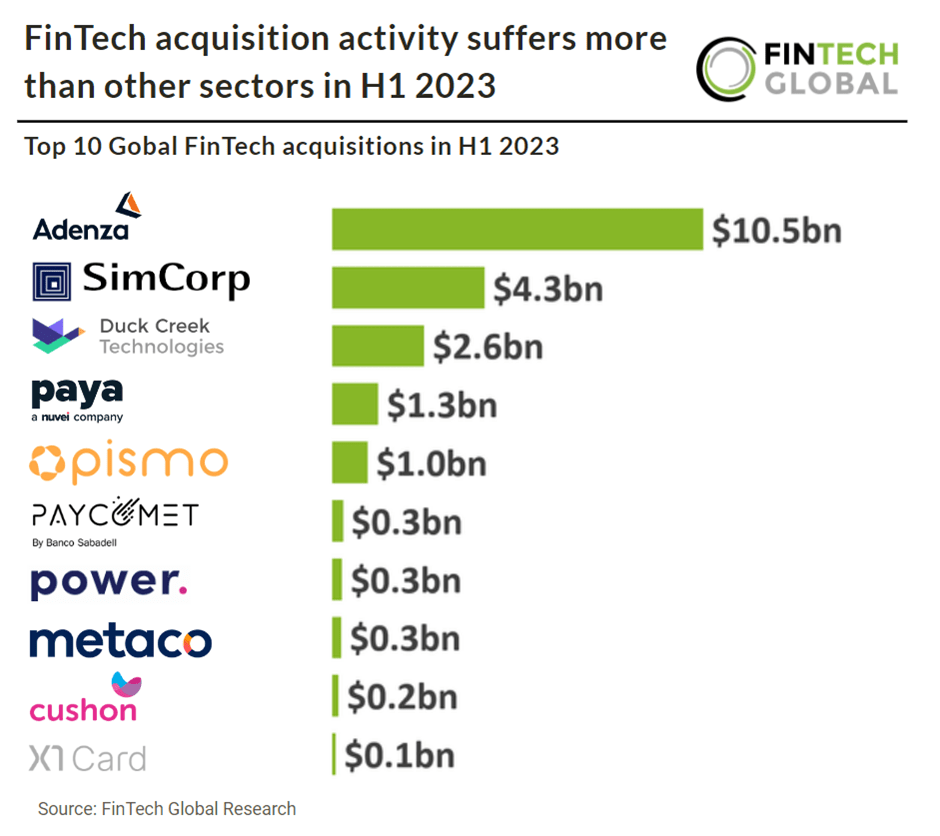

FinTech acquisition activity suffers more than other sectors in H1 2023 (Fintech Global)

The number of FinTech acquisitions in H1 2023 decreased by 50% compared to the previous year, totalling at 174 acquisitions. FinTech acquisition activity experienced a 20 percentage point decline compared to the overall market. Reasons for this can be attributed to uncertainty around declining valuations. According to Sifted, the average early-stage valuations (Series A to C) are down 23% from Q1 of last year while late-stage valuations (Series C+) have fared substantially worse, registering a year-on-year decline of 77%. Read more

–

Do you have any news to share: please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion