The fintech industry is rapidly evolving and disrupting traditional financial systems. In this article, we bring you the latest research insights to help you stay ahead of the curve and understand the future of financial technology. Enjoy researching!

UK Banks Are Failing SMEs Needing External Finance; Threatening ‘Rise in the Number of Insolvencies’ (The Fintech Times)

UK banks appear to be growing increasingly reluctant to lend to SMEs, with 67 per cent of UK SMEs believing they are less willing to lend to them today – increasing to 71 per cent for SMEs with a turnover between £1million and £5million. Data from research by independent SME funder, Bibby Financial Services, also found that 43 per cent of UK SMEs believe their need for external finance has increased compared to six months ago. However, while almost half of UK SMEs require more help, more than half (54 per cent) said it is harder to access finance. Read more.

51% of Financial Services Firms Reporting Breaches are From US: Trustwave Threat Landscape Report (The Fintech Times)

Cybersecurity and managed security services provider, Trustwave, has revealed the biggest cyber threats facing financial services organisations after its latest research.

The Trustwave report, ‘2023 Financial Services Sector Threat Landscape: Trustwave Threat Intelligence Briefing and Mitigation Strategies‘, explores the specific threats and risks the financial services industry faces, along with practical insights and mitigations to strengthen defences. Read more

The best and worst performing fintech companies in the AltFi Fintech Index in 2023 (AltFi)

As in any index, the relatively modest 14.3 per cent return of the AltFi Fintech Index in 2023 belies some big movements both up and down for a smaller number of stocks. In 2023, ten stocks more than doubled in investors’ money in the first three quarters of the year while another ten lost more than a quarter of their value over the same time period. In this article, we take a brief look at these 20 risers and fallers. Read more

76% of payments providers are frustrated with the lack of VRP progress

(AltFi)

There is significant interest among UK payments providers to harness the potential of open banking, according to a survey of payment service providers (PSPs) by open banking provider Nuapay. Three-quarters of PSPs reported that they’re planning to integrate variable recurring payments (VRPs) and collectively expect over half (51 per cent) of their payment flow will convert to open banking in the next three years. “The growth anticipated from PSPs highlights the amazing momentum behind open banking,” Annemarie Graham director of strategic partnerships at Nuapay said. Read more

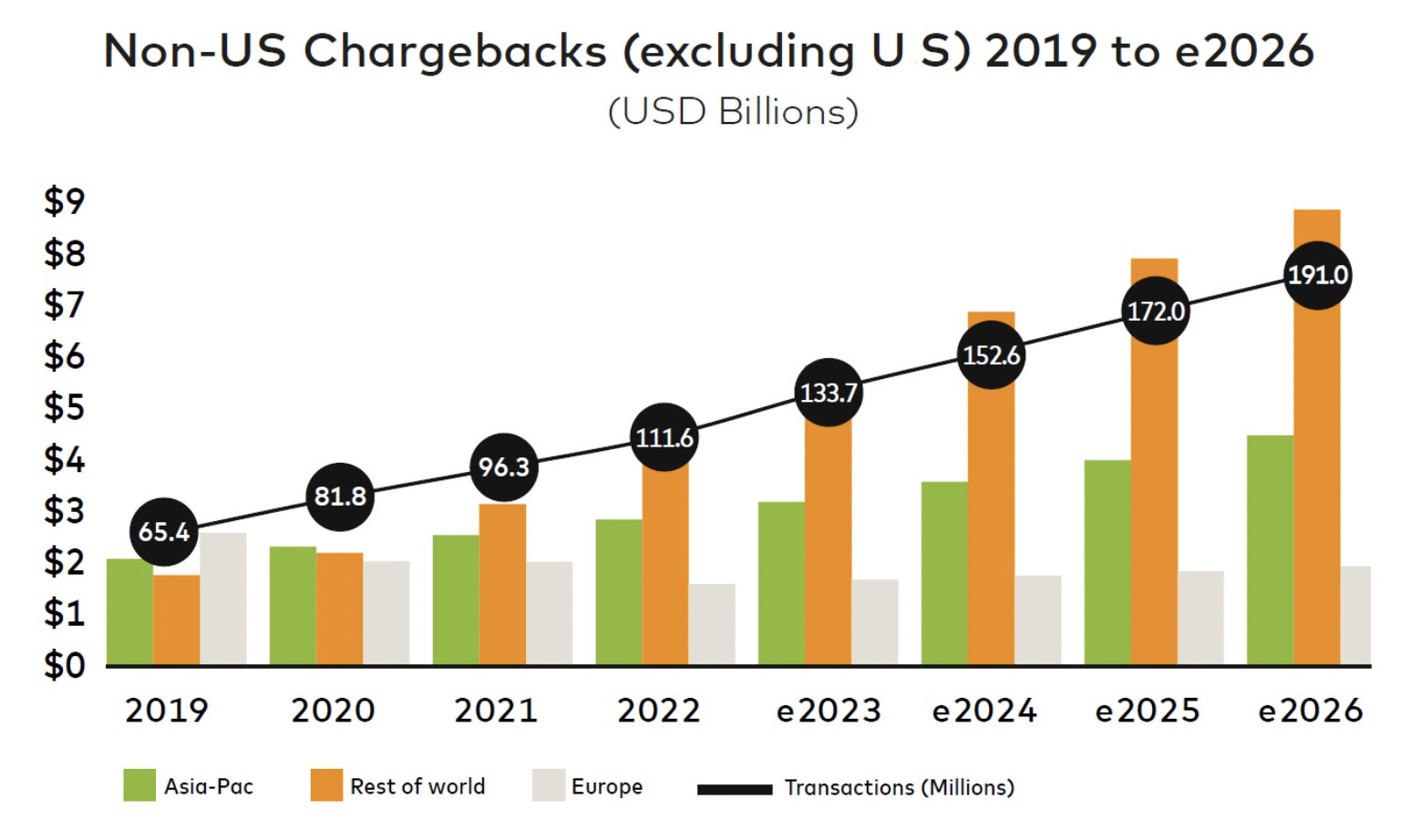

The burgeoning growth of chargebacks (Payments, Cards & Mobile)

Around the world we’ve experienced rapidly changing dynamics over the last few years. There’s been large-scale transformation to the workforce and global supply chains, along with the emergence of new consumer attitudes and shopping behaviours. During COVID-19, e-commerce experienced a huge growth spurt as people turned to online shopping for everything from groceries and household goods to clothing. Read more.

In focus: European merchant acquiring market 2022 (Payments, Cards & Mobile)

Jeffries recently made a deep-dive analysis of the Nilson Report’s annual Top Merchant Acquiring ranking to compare top players, annual changes and track evolution of payments companies vs. banks. Post several intensive years of consolidation, Nexi and Worldline ranked again at the top, while Adyen, 5th, surpassed Barclays, at 7th, and Worldline’s future JV partner Credit Agricole came in 9th. Read more.

EIF Working Paper 2023/94, Open banking and inclusive finance in the European Union (EIF)

This working paper examines the impact of the revised Payment Services Directive (PSD2) and open banking (OB) platforms on inclusive finance in the EU, with a focus on the Netherlands’ FinTech ecosystem. While PSD2 aims to enhance financial inclusivity, challenges remain mainly because it was not designed for this purpose. This study identifies key areas for improvement and emphasizes the role of regulators in fostering an inclusive open banking sector in the EU. Read more.

-

Do you have any news to share: please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion