The fintech industry is rapidly evolving and disrupting traditional financial systems. In this article, we bring you the latest research insights to help you stay ahead of the curve and understand the future of financial technology. Enjoy researching!

Reconciliation and Settlement of Card Payments via Instant Payments and Premium Payment APIs: A White Paper as an Introduction to the Topic (The Berlin Group)

This document discusses the potential integration of card transactions with the SEPA Credit Transfer Instant (SCT Inst) scheme, aiming to leverage synergies for clearing and settlement processes. The current two-step process involves clearing (transaction data validation) and settlement (transfer of funds) between card issuer and acquirer banks. The proposal suggests extending SCT Inst processes for card transactions, promoting Straight-Through-Processing (STP) and reducing clearing costs. Read more

Global Risks Report 2024 (World Economic Forum)

The Global Risks Report, published by the World Economic Forum, examines severe risks anticipated over the next decade amid rapid technological change, economic uncertainty, climate change, and geopolitical tensions. As global cooperation faces challenges, even minor shocks could push weakened economies and societies beyond the tipping point of resilience. The report provides a comprehensive overview of key findings, featuring an online reader with the full report, deeper insights into global risk perceptions, shareable content, and multimedia resources such as videos and radio conferences. The agenda highlights major global risks in 2024 and beyond, emphasizing climate risks, growing challenges, and the need for enhanced resilience in business and society. The report builds on previous editions, including the Global Risks Report 2023 and 2022. Read more

Workers to organizations: We’re just not that into you (McKinsey & Company)

Do you ever feel like you utterly despise your 9-5? You are not alone – The McKinsey report highlights a concerning trend where more than half of surveyed employees express dissatisfaction at work, impacting both morale and organizational value creation. The research identifies six employee archetypes along a satisfaction spectrum, offering a quiz for managers to determine the prevalent types within their teams. Read more

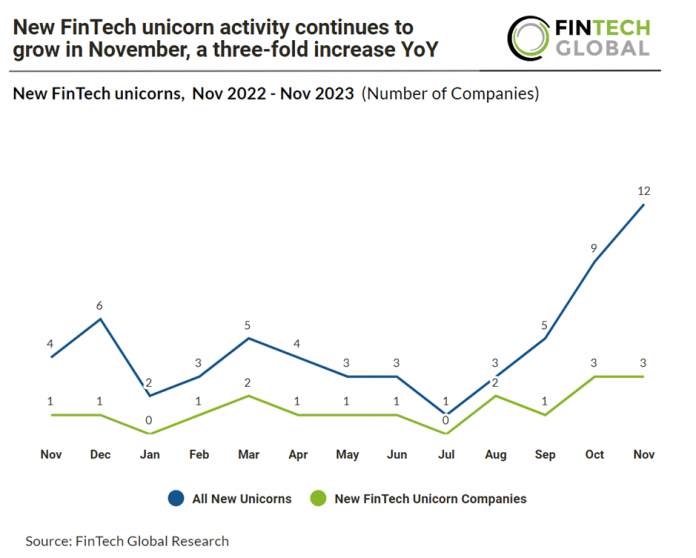

New FinTech unicorn activity continues to pick up after slow start in 2023 (Fintech Global)

In November, FinTech unicorn activity remained robust with 12 new unicorn announcements, a 33% increase from October. Notable additions include Tabby, a buy now pay later provider securing $58 million in Series C funding, InCred Holdings Limited raising INR 500 Crores ($60 million) in its Series D round, and BioCatch, specializing in fraud detection, achieving unicorn status through a $70 million secondary deal with Sapphire Ventures. These developments highlight sustained growth and investor confidence in FinTech companies across various sectors and geographic regions, with a particular focus on enhancing financial services and technology innovation. Read more

Hawkish or dovish central bankers: do different flocks matter for fiscal shocks? (European Central Bank)

The column has nothing to do with birds – rahter, it discusses the impact of US monetary policy on the economy’s response to fiscal spending. The authors at the European Central Bank use historical data on the hawk-dove balance within the Federal Open Market Committee (FOMC) since 1960 to measure systematic monetary policy. The balance reflects the composition of FOMC members who are either more concerned about inflation (hawks) or focused on supporting employment and growth (doves). Read more

FinTech investment takes a hammering in 2023 (Payments Cards & Mobile)

The global FinTech sector faced significant challenges in 2023, marked by a 48% drop in investment compared to 2022, with $51.2 billion invested across 3,973 deals. The decline is attributed to macroeconomic uncertainties, including inflation, hawkish monetary policies (see above), supply chain issues, and potential recession. Early-stage FinTech investment remained robust, with over $4 billion invested in seed rounds. However, mega-deals of $100 million and above showed a decline, suggesting lower growth-stage valuations. The average deal size fell to $12.9 million from $15.5 million in 2022, but it remains higher than the average recorded from 2012 to 2020. Read more

Unveiling the landscape of Fintech in ASEAN: assessing development, regulations, and economic implications by decision-making approach (Nature)

The article titled “Unveiling the landscape of Fintech in ASEAN: assessing development, regulations, and economic implications by decision-making approach” provides a detailed assessment of the influence and potential of Fintech in the Association of Southeast Asian Nations (ASEAN) countries. The study aims to evaluate the levels of development in financial activities, technology infrastructure, and Fintech-enabling regulations across the region. The researchers employ a robust decision-making framework that combines numerical and linguistic assessments, utilizing the Distance-based CRiteria Importance Through Inter-criteria Correlation (DCRITIC) method and the Fuzzy extension of Evaluation based on Distance from Average Solution (F-EDAS approach). Read more

–

Do you have any news to share? Please put feed@hollandfintech.com on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion