The fintech industry is rapidly evolving and disrupting traditional financial systems. In this article, we bring you the latest research insights to help you stay ahead of the curve and understand the future of financial technology. Enjoy researching!

Crypto Report (PitchBook)

Download the preview of PitchBook’s 2023 Q4 Crypto Report to explore the rebound of the crypto industry, marked by a $1.9 billion deal value across 326 deals in Q4 2023, the first increase since Q1 2022, fueled by positive sentiment around the imminent approval of spot bitcoin ETFs. Gain insights into the crypto landscape, VC ecosystem, emerging opportunities like centralized market makers and Bitcoin Layer 2, and highlights of select companies such as Babylon and Rhinestone. Read more

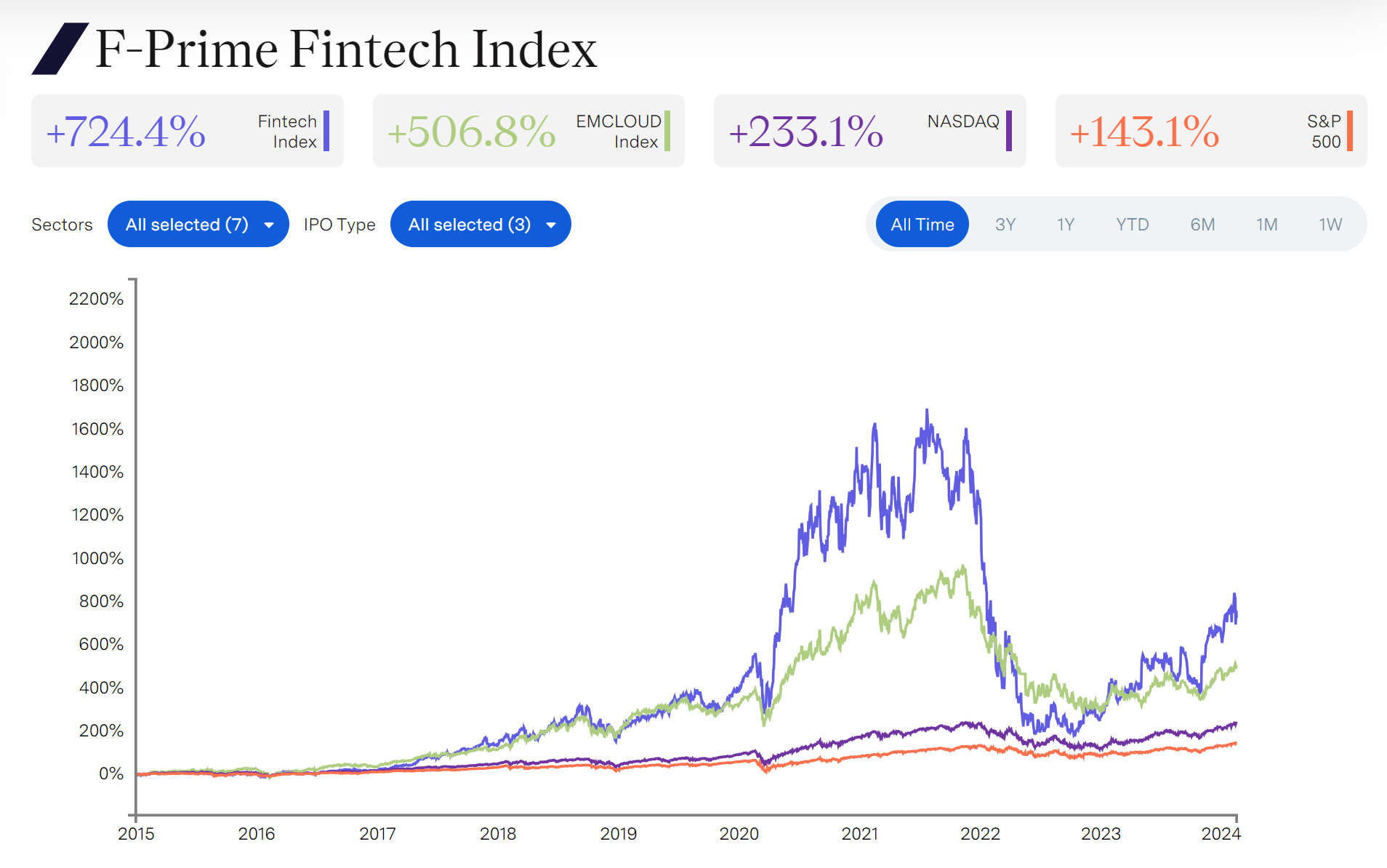

F-Prime Fintech Index (F-Prime)

Explore the F-Prime Fintech Index 2024 Report, monitoring the performance of 49 emerging, publicly traded financial technology companies with a combined market cap of $589.9 billion and a 4.04x revenue multiple, providing insights into company comparisons, multiple benchmarks, historical metrics, and sector performances, while highlighting key players such as Adyen, Affirm, Coinbase, and Nubank and delving into potential future listings. Read more

The Global Payments and Fintech Trends Report 2024 (The Paypers)

Gain invaluable insights into the rapidly evolving payments sector by exploring The Paypers’ Global Payments and Fintech Trends Report 2024, which delves into key trends, impacts, and opportunities in Asia Pacific and Europe, examining regional influences on the payments landscape through demographic shifts, political considerations, technological innovations, and regulatory changes. The report also covers the evolution of A2A payments in Europe, trends in cross-border payments (B2B, B2C, and C2B transactions), the impact of Open Finance and Embedded Finance on financial services, the global drive towards real-time payments through Paytech modernization, and the evolutionary trends in financial security, including fraud sophistication and regtech compliance. With insights from leaders and experts across the financial services spectrum, this report provides actionable strategies and recommendations for navigating the dynamic payments and fintech landscape. Read more

Building a resilient tomorrow: Concrete actions for global leaders (McKinsey & Company)

Move beyond rhetoric and take tangible steps towards building resilience with the comprehensive report “Building a Resilient Tomorrow: Concrete Actions for Global Leaders,” published in collaboration with the World Economic Forum in January 2024. Developed by the Resilience Consortium, this report showcases nine in-depth case studies across climate, energy, and food; supply chain; and organizational readiness themes, spanning the public and private sectors across four continents. It offers actionable insights and identifies seven priority actions across three pillars: building resilience capabilities, understanding and monitoring resilience journeys, and fostering public-private partnerships. Authored by World Economic Forum and McKinsey & Company, the report serves as a guide for senior leaders navigating a risk-prone world. Read more

Climate transition risk in the banking sector: what can prudential regulation do? (European Central Bank)

This paper, utilizing a Dynamic Stochastic General Equilibrium (DSGE) model incorporating heterogeneous firms, financial frictions, and prudential regulation, highlights the imperative for climate-related capital requirements within the existing prudential framework to address the increasing climate-related risks that pose serious threats to financial stability. The study reveals that the absence of specific climate prudential policies could result in excessive risk-taking by banks, amplifying lending and output volatility. Emphasizing the inadequacy of relying solely on microprudential regulation, the paper advocates for the implementation of macroprudential policies alongside microprudential regulation, demonstrating a Pareto improvement in addressing the systemic dimensions of transition risk. Read more

-

Do you have any news to share? Please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion