The fintech industry is rapidly evolving and disrupting traditional financial systems. In this article, we bring you the latest research insights to help you stay ahead of the curve and understand the future of financial technology. Enjoy researching!

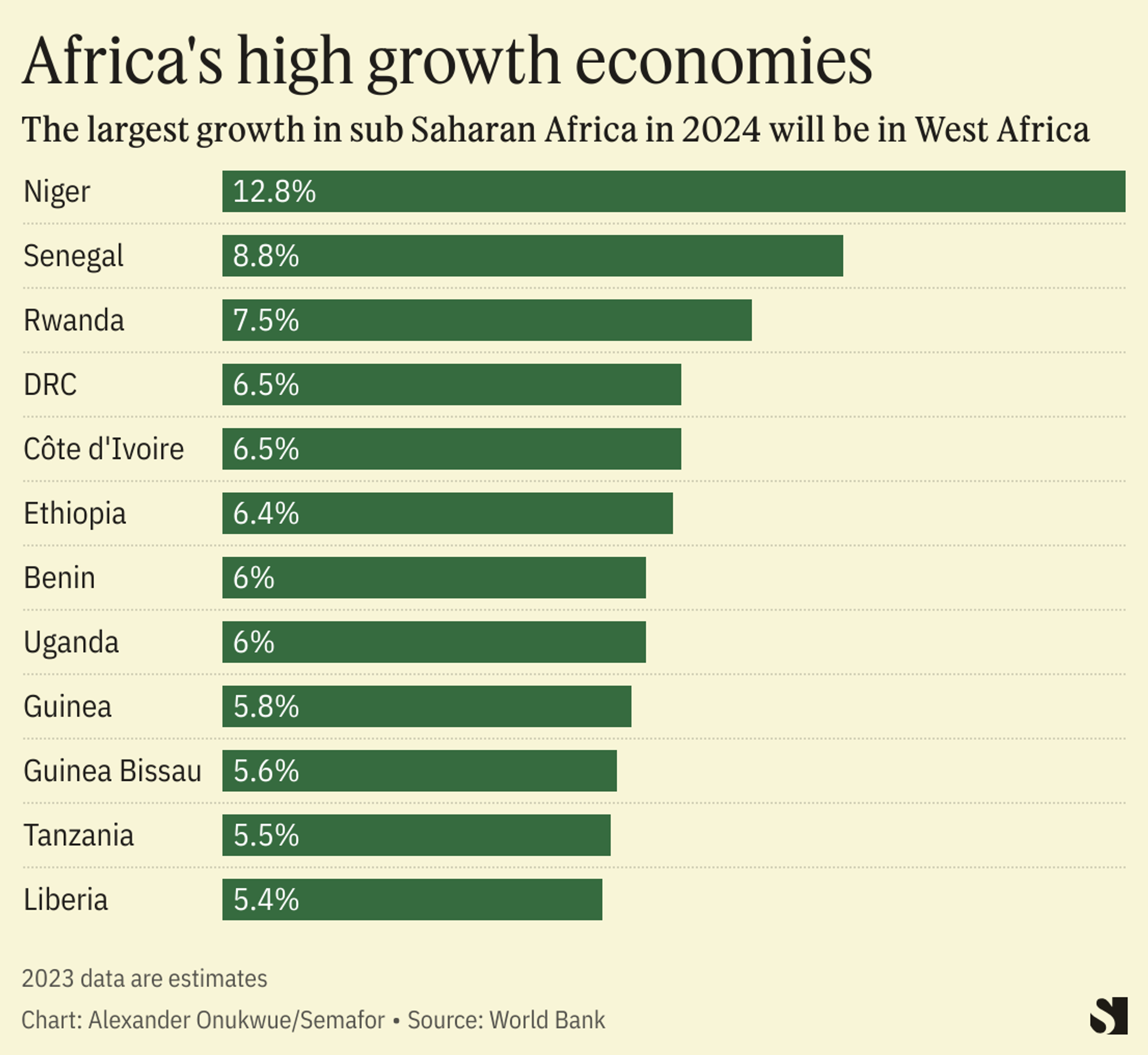

Six African countries are among the world’s highest growth economies in 2024 (Semafor)

The World Bank projects strong economic growth in Niger, Senegal, and Rwanda in 2024, driven by factors like oil production and diversification efforts. Meanwhile, larger African economies like Nigeria, South Africa, and Angola are expected to lag due to various challenges. Overall, sub-Saharan Africa’s growth is forecasted at 5%, with concerns about conflicts and external shocks exacerbating food insecurity in the region. Read more

Unlocking the E in ESG (Copenhagen Fintech)

In the Nordic region, the fintech industry stands out for its pioneering efforts in integrating environmental, social, and governance (ESG) principles into financial services. Through collaborations with climate fintechs and partnerships with organizations like PA Consulting and Finans Denmark, the Nordic fintech ecosystem has been actively advancing sustainable solutions. A recent comprehensive report, informed by in-depth interviews and expert insights, highlights the sector’s commitment to environmental responsibility. This report maps out the Nordic climate fintech landscape, showcasing how these partnerships are driving significant advancements towards sustainability. By transcending the boundaries of traditional finance, these collaborations are not only reshaping the financial sector but also accelerating the green transition for institutions and organizations. The report provides valuable insights into the strategies, technologies, and collaborative efforts shaping the integration of ESG principles into financial services across the Nordic region, ultimately contributing to positive environmental and social impacts. Read more

Escaping the legacy mindset: How to approach modernising your payments ecosystem (Compass Plus Technologies)

For over 15 years, the demise of legacy systems has been predicted, with vendors and analysts warning financial institutions (FIs) to migrate to modern technology cores or risk becoming obsolete. However, this transformation has yet to materialize. Instead, the industry has evolved into a landscape characterized by integration, partnerships, and complex systems reliant on payment orchestration layers and integration wrappers. The proliferation of fintechs and niche players has further emphasized front-end innovation at the expense of core systems, as FIs prioritize consumer demands for immediacy. In our latest white paper, developed in collaboration with Consult Hyperion, titled ‘Escaping the legacy mindset: How to approach modernizing your payments ecosystem’, we advocate for a reevaluation of long-term strategies. We analyze current payment system architectures, exploring their advantages, drawbacks, and optimal placement within your tech stack. This resource is essential for C-level executives and payments professionals seeking to break free from legacy constraints and build a future-proof ecosystem. Read more

AI has a lot of terms. We’ve got a glossary for what you need to know (Quartz)

Quartz offers a comprehensive guide to core AI terminology, recognizing that public perceptions of artificial intelligence are often shaped by popular media representations such as “I, Robot” and “Ex Machina.” While these portrayals often depict dystopian scenarios where intelligent robots pose existential threats to humanity, the reality of generative AI technology is still in its nascent stages. Despite its potential to disrupt elections or leak sensitive information, chatbots and other AI applications frequently make significant errors. However, as the field continues to evolve, understanding key terms like “semiconductor” and the distinctions between GPU, CPU, and TPU becomes essential for navigating the complexities of this rapidly advancing sector. Quartz’s guide aims to demystify these concepts and provide clarity for those seeking to stay informed about the latest developments in AI. Read more

Instant Payments Regulation (Bird & Bird)

The EU’s Instant Payments Regulation (IPR) aims to facilitate instant credit transfers in euro across the European Union. It amends existing EU payments regulations to ensure availability of instant payments, introducing requirements for instant credit transfers, verification of payee, sanctions screening, and access to designated payment systems. Implementation deadlines vary for different categories of payment service providers (PSPs), with Eurozone-based PSPs required to comply earlier. The IPR represents a significant effort to modernize the European payments landscape, enhancing efficiency, accessibility, and regulatory compliance. Read more

-

Do you have any news to share? Please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion