Fortech and Ross Republic kickstart a new cooperation to offer banks and fintechs the best of innovation and technology strategy and software development. Together, we help financial institutions to seize the latest technological possibilities and bring new digital propositions to the market.

Ross Republic already supports its banking and fintech clients with bespoke market research as well as strategy and innovation consulting to ensure a successful digital transformation. Each of our clients’ challenges as well as opportunities in digital banking are unique, thus we believe in building up a unique ecosystem of transformation partners, so that no matter your ambition, we guarantee to offer the right kind of expert knowledge and execution support.

That’s why we’re now adding another powerful player to our ecosystem. We’re joining forces with Fortech, a leading software engineering partner for financial services providers, which has been awarded by EY, Forbes, and repeatedly included in Deloitte rankings of the fastest-growing technology companies. Our combined strengths enable financial institutions to rapidly formulate their digital visions and strategies, and to follow up with swift execution. Together, we boost your digital transformation with speed, scale and innovation.

Take your digital strategy to the next level

Our consultants are experts in both fintech and traditional banking innovation. Utilise our specialist knowledge to identify new digital opportunities and to build new cultures, structures and capabilities to participate in the digital banking ecosystem with new value propositions.

Drive revenue and improve customer relationships

We have supported numerous financial services players in researching client needs and translating client and market insights into new products and services that unlock new monetization opportunities. Ensure long-term client loyalty using the latest technologies that set new customer experience standards.

Reduce costs with streamlined backend IT

Successful digital transformation requires a group-wide common technical basis that reduces the overall IT costs and ensures a future-proof set-up. We specifically focus on cloud migration and the shift towards microservice architectures.

Read more below about how we’re tackling the financial industry’s current challenges together and thus helping financial institutions get most out of their digital transformation journeys.

Accelerating digital transformation for financial services clients

The need at financial institutions to fully embrace digitalisation as a key business driver has never been greater. Digital challengers, both from within and outside the industry, are amplifying customer expectations, building on new technology infrastructures and establishing digital business and distribution models. The Covid-19 crisis has forced banks to quickly adjust operations for the 1.5 meter, digital-first economy, and hence further intensified the need to kickstart end-to-end digital transformation across business units.

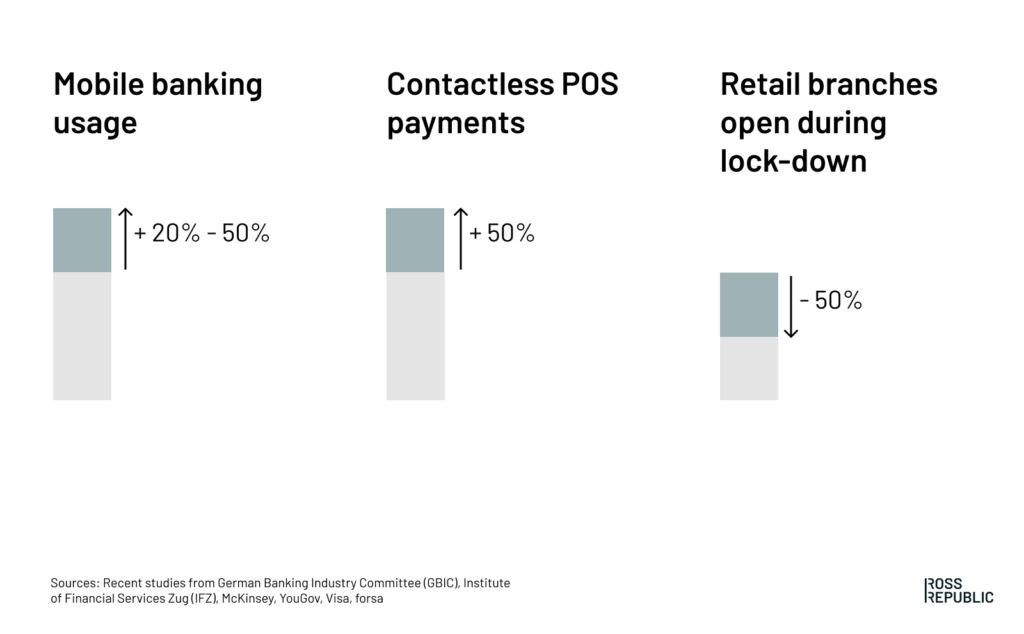

Based on latest market research, the crisis truly accelerated the shift towards digital banking:

- Online and mobile banking has become the forced default during lockdown, with usage increases from up to 20% – 50% depending on the market

- Cash payments are in decline, while contactless POS payments are rising up to 50%

- Customers across segments have experienced the benefits and convenience of digital banking solutions. The newly formed digital banking behaviours are expected to stick: For instance, 95% of new mobile payment users stated to now have a better expense overview than before

- Many banks closed up to half of their branches during the pandemic. The importance of physical sales channels further decreased, while the importance of 24/7 self-service capabilities and high-quality digital channels increased

- Simple and easy to use digital banking products and services are clearly increasing in demand – the prevailing complex product portfolios and terms offered by many traditional banks are representing significant growth bottlenecks

Sources: Recent studies from German Banking Industry Committee (GBIC), Institute of Financial Services Zug (IFZ), McKinsey, YouGov, Visa, forsa

COVID-19 ACCELERATES THE SHIFT TOWARDS DIGITAL BANKING

As a result, post-Covid-19 it can be expected that standard banking products are further commoditised, while convenient digital-first banking providers win additional market share. Traditional financial institutions now urgently need to follow a clear digital north star vision, rapidly develop internal digital capabilities and ways of working, and launch differentiated digital value propositions.

A fast shift to digital operations and business models is easier said than done. The technology systems at financial institutions are approaching the end of their lifecycle. Legacy systems are often fragmented and custom-built, which represents a real blocker for business transformation. Even if the internal mind-set is focused on innovation and growth, the technical implementation still slows down many projects.

It’s of tremendous importance to bridge business and innovation strategy with technological expertise and execution capabilities

Given the current business environment, it would be fatal to focus on individual digitalization measures without taking a holistic perspective into account. Successful digital transformation starts with a differentiated purpose and value proposition that is reflected in the business and operating models. That’s why it’s of tremendous importance to bridge business and innovation strategy with technological expertise and execution capabilities. For this reason we are joining forces with Fortech, one of the largest CEE software services companies.

Providing end-to-end digital transformation expertise

Fortech is a leading software engineering partner for financial services providers, while Ross Republic offers expert fintech and digital transformation strategy consulting. Together, we support financial services providers in connecting their technology initiatives with business strategy, both on a strategic and operational level.

The financial services industry is going through an unprecedented period of digital transformation, accelerated by the Covid-19 crisis. Banking is becoming a technology and data play, hence modern IT infrastructures become the license to operate successfully in all domains of financial services. Digital financial services based on best-for-purpose systems, cloud-based core banking systems, independent microservices and the usage of internal and open/partner APIs are key success factors.

Financial services providers know this well and are heavily investing into IT modernization. Yet, they are held back by technology and organizational debt, while new regulations, such as the Second Payment Services Directive, and Banking-as-a-Service platforms further increase competition in the sector. That’s why the need for holistic transformation partners that have deep expertise in tech-driven financial services, both on a technology and business level, has never been greater.

Fortech provides end-to-end software engineering services, having over ten years of experience in writing software for the financial sector with latest case studies in AI risk management platforms, open banking API development and digital loan processing.

Ross Republic is a strategy and innovation consultancy specialized in financial services, offering a team of seasoned digital transformation consultants and hands-on fintech experts that have worked for cutting-edge fintechs (N26, Holvi, Finleap) and incumbent banks (BBVA, Danske Bank) alike.

By working with Fortech x RR, financial institutions and fintechs alike now have access to a unique business transformation service that holistically bridges technology and business strategy.

We initially focus on the three key areas:

- open banking

- digital lending

- the migration to microservice architectures

Open Banking

The introduction of the Second European Payment Services Directive (PSD2) has finally put the topic of APIs on the management agenda. The updated regulation has forced banks to offer APIs to licensed third parties (TPPs, third party providers), which can in turn access transaction data and initiate payments on behalf of their clients. Download this whitepaper by Fortech to find out more about the evolution of financial services and the impact of Open Banking APIs.

According to Tink, average investments in open banking grow by 20% – 29% per year. The top three intentions behind these investments are:

- Providing a better customer experience

- Modernizing the technology stack

- Optimizing processes and operations

As PSD2 was clearly driven by the regulatory body, the first implementation phase was all about becoming compliant. Now, some of the key questions are:

- What open banking business models and propositions are the right fit?

- How can the bank effectively and securely monetize its data and banking capabilities by cooperating with third parties?

- What comes after open API platforms and hackathons? How should external partners be selected and how can a thriving ecosystem be developed?

- How can the bank play a more proactive role in product and use case discovery?

There are manifold business opportunities for both sides, financial institutions and TPPs.

In order to advance from a regulatory-driven open banking approach to leveraging open banking for business innovation, we offer:

- Custom user and market research

- Open Banking workshops and webinars to showcase latest innovations, use cases and emerging business models

- Open banking strategy development: a collaborative approach between the bank’s tech and business stakeholders to form a common open banking vision and develop an open banking strategy and roadmap

- Aligning internal teams to decide on open banking initiatives and developing propositions from first ideas to final launch

- Launching structured internal innovation processes that enable employees to strategically ideate, select, validate and launch API-based services

- Open banking API development and integration, as well as application development leveraging third-party APIs

Ross Republic offers the Open Banking Strategy Canvas to facilitate initial discussions about open banking approaches within the bank. Our consultants have been part of innovative beyond banking projects, e.g. by utilizing APIs to merge business banking with accounting and other non-banking service providers.

Fortech has recently applied its financial software development expertise to empower one of its U.K. clients in developing an open banking API platform. The solution integrates open banking APIs and provides clients with an easy and secure way to access account information from financial institutions and initiate payments. At the same time, it provides financial companies with a consistent and easy to use toolkit and enables them to build modern and regulatory compliant financial applications.

Get in touch to discover your own open banking opportunities with us.

Digital Lending

One of the high impact/low effort opportunity areas in digital banking is the digitalization of credit application processes, credit decisions and loan provisioning. In a post-Covid-19 world, clients might hesitate to visit the branch for applying for simple consumer or business loans and instead use a digital channel to compare their options and select a suitable offering.

In the first step, such loan offerings are directly embedded in the bank‘s mobile or web applications and nudge users to explore tailored credit options. Beyond that, consumer loans can be optimized for e-commerce or third party environments, such as installment loans for online purchases.

In business banking, digital loans should be an integral part of the online banking environment, and can further be optimized for business segments, e.g. as integrated factoring solutions or software subscription securitization. Further, we see opportunities for banks to embed their credit facilities in B2B2X models, such as integrated merchant lending solutions for platform players. When it comes to risk scoring models, new data analytics solutions offer the opportunity to further personalize credit offerings, speed up decision making and decrease default rates.

In order to advance your digital credit capabilities Fortech and Ross Republic offer:

- Custom user and market research

- Digital lending workshops and webinars to showcase latest innovations, use cases and emerging business models

- Digital lending strategy development: a collaborative approach between the bank’s tech and business stakeholders to form a common digital lending vision and develop a digital lending strategy and roadmap

- Aligning internal teams to decide on digital lending initiatives and developing propositions from first ideas to final launch

- End-to-end custom digital lending solution development and integration with core banking systems

For instance, a major Romanian financial institution has chosen Fortech to develop a banking application designed to digitize, facilitate, and automate the lending process and reduce the physical time spent by customers at local branches. The app evaluates customers based on risk criteria, cuts the time spent applying for a loan to a matter of minutes and wastes no paper in the process. APIs from multiple regulatory agencies and other internal bank API’s of the client are integrated into the solution to ensure the lending process is compliant with all EU regulations and its workflow is automated across the banking systems.

Ross Republic has recently completed a digital growth plan 2020-2023 project for a Nordic mid-size bank, with a focus on digital credit products: “The strategy team had vast general industry knowledge, and were excellent listeners. They picked up the essentials and challenged us with great insights.” – Director, financial product and services

Get in touch with us to learn how to shift your credit provisioning to digital channels.

Migration towards microservices

In the past, the IT departments’ limited role as internal service provider as well as the legacy monolithic IT systems actively prevented customer centricity and business agility. At the same time, one-off big bang migrations over wholesale have proven to be risky, costly and time consuming. A successful approach that allows taking the unique IT legacy of the bank into account is the hollowing out approach, i.e. the migration of single services or business lines as microservices. Thus, the modularisation of the IT landscape is often a first step in digital transformation to enable the individual development of single services, often ultimately underpinned by a common group-wide cloud-based IT infrastructure and core banking system. Next to the shift to microservices, the integrability with new technologies and services providers is a critical success factor.

Fortech and Ross Republic are excellent business transformation partners for financial institutions that want to kickstart their journey towards cloud-based microservice architectures:

- Microservice and cloud banking workshops and webinars to showcase latest innovations, use cases and emerging business models

- Microservice strategy development: a collaborative approach between the bank’s tech and business stakeholders to form a common cloud banking and microservice vision, to develop a “service-based” internal mind-set and to follow-up with an actionable microservice strategy and roadmap

- Aligning internal teams to decide on the initial business lines for microservice transformation and developing propositions from first ideas to final launch

With extensive expertise in Cloud development and upgrading legacy IT systems to modern technologies, Fortech has successfully implemented several migration projects from monolith to microservices. For example, when developing the retail banking application mentioned above, Fortech designed a microservices architecture, based on Java, RabbitMQ and Angular. This enabled the client to stabilize the application, shorten the release cycles and gain a quality advantage by splitting business functionalities and testing them separately.

Another example is the migration of a large back office platform for products, services, manufacturing, and billing, for one of the largest telecommunications companies in Europe. Due to its size and complexity, Fortech approached the project by first stabilizing the application, creating a CI/CD pipeline, adapting to the new infrastructure, and breaking the monolith into smaller, independent applications that communicate through various technologies. The solution is modularized by using the microservices architecture and provides an open API with a configurable data model.

Ross Republic has experience in helping traditional financial services providers kickstart digital transformation efforts by translating emerging technological possibilities into business opportunities and integrating them into the company-wide strategy and change development process. For instance, we support management teams in formulating banking strategies that leverage new technological possibilities. We further support strategic decision making with custom research programs, from user research to bespoke market landscaping and extensive benchmarking.

Get in touch with us for a tailored assessment of your cloud banking and microservice opportunities.

Helping financial institutions to shift to digital fast

Traditional banks are still operating as trusted brands, especially as they played a pivotal role in supporting businesses during the current economic crisis. According to a recent consumer survey by YouGov in the U.K, “only 17% say challengers are as reliable and trustworthy as regular banks, and only 19% say they’re easier to use. “

The banks that take digital transformation serious now have the opportunity to strengthen their market share and cut operating costs significantly, while gaining new opportunities for growth post Covid-19.

Contact us to get your tailored digital transformation assessment.

About Fortech

Fortech is a Romanian software services company, one of the largest IT service providers in the CEE region, awarded by EY, Forbes, and repeatedly included in Deloitte rankings of the fastest-growing technology companies.

As a technology partner for Financial Services companies, we build dedicated teams that truly integrate and provide full-stack, end-to-end custom software development services. Leveraging a quality-focused culture, agile and modern technologies, we support and accelerate digital innovation.

About Ross Republic

Ross Republic is a strategy and innovation consultancy, creating sustainable business foundations for financial services companies. We’re currently complementing our strategy and innovation services with an industry-leading ecosystem of technology and innovation partners for

- banks that want to accelerate their digital transformation

- fintechs that want to build and scale their propositions

- non-banks that want to seize opportunities from embedded finance

Read more about our other partners Hubuc (Banking-as-a-Platform) and Kong Inc (API management).