Written by Liam Thomson, Finance & FinTech

On the 19th March, DirectID CEO James Varga hosted a webinar to discuss a number of use cases that are likely to thrive with the extension of Open Banking to Open Finance. In this post, we have summarised the session and attached the full recording to view in your own time.

Introduction

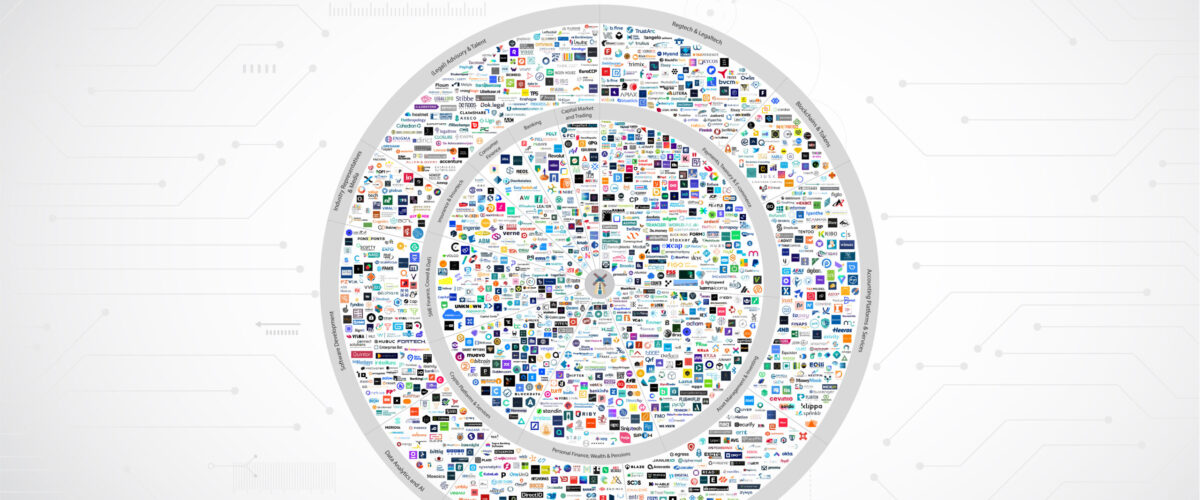

Despite the sea of challenges financial services has fought against in the last year, we are fast approaching exciting times. Open Banking adoption is at an all-time high with there now being 28 countries (and growing) that have launched Open Banking programmes. This coincides with wider financial services undergoing a huge transformation. Financial organisations have been digitising their processes to give consumers more access to services online. In some ways the pandemic has acted as ‘the perfect storm’, forcing financial firms to consider new ways of operating and to adopt new technologies such as Open Banking.

This change in thinking has accelerated the adoption of Open Banking products and services in a number of key sectors. Open Banking is ‘flipping the model’ of data ownership in each of these industries, moving away from tradition and putting consumers in power of their own data.

Over the last 12 months this has laid the groundwork for Open Finance and, in many ways, Open Finance is just a small extension of Open Banking. But with access to a wider range of accounts, the potential to drive innovation becomes even higher.

Identifying Emerging Financial Distress

Emerging financial distress (EFD) identification is high on the list of priorities for organisations all over the world to help overcome portfolio challenges associated with the pandemic.

DirectID have been working on a number of projects surrounding EFD that highlights the need for Open Banking products and services. The Financial Conduct Authority recently recruited DirectID for their Digital Sandbox Pilot. The project aimed to provide support to innovative firms who are tackling challenges relating to, or exacerbated by, coronavirus. As part of the project DirectID pulled together a variety of data sources to solve challenges surrounding the identification of EFD.

With the DirectID insight capabilities, we’re able to leverage bank data to identify key indicators of EFD such as income versus debt ratio, or use the data to identify behavioural indicators of EFD. This better equips businesses to pre-empt financial distress throughout a customer’s lifecycle with the business. Many of our customers are already leveraging Open Banking to better understand financial distress.

When we open the scope to Open Finance, however, there becomes a much more complete view of a customer’s financial circumstances. By linking in accounts such as savings or long-term investments we can attain a wider view on an individual’s likelihood to fall into a vulnerable or financial distressed position. Currently, debt advice agencies and other similar services are limited by a view on current account. Open Finance provides a wider scope for agents to be able to offer more tailored advice to their customers.

Leveraging Bank Data in Portfolio Management

Credit risk is a universal problem. It’s the same equation that every underwriter needs to assess; how much an individual makes versus how much they spend. Calculating and understanding affordability makes up 80% of any credit risk decision. The remaining 20% usually comes from negative credit risk indicators such a gambling habits versus how much you save. With an Open Finance lens lenders could leverage insights on credit card spend, paypal accounts, wallets etc. to feed into this decision. With the increase in traction of cryptocurrencies like bitcoin, the average person has a much broader portfolio outside of traditional assets. By leveraging Open Finance data portfolio managers can use this information make better decisions.

In a portfolio of 1000 customers, for example, a lender may want to understand who the employer of its customers are. If 100 of the customers work for Amazon, the lender may wish to segment them from other employers such as hospitality companies that are currently less stable.

Collections & Recoveries

The collections process, typically post delinquency, can be an extremely stressful and arduous process for customers. When describing the traditional process customers felt it was ‘embarrassing’ and ‘stress-inducing’. Open Banking brings an opportunity to increase efficiency and customer experience.

Building a customers Standard Financial Profile, the core component of any collections assessment, usually takes around an hour. With the introduction of bank data this can be shortened to a few minutes and removes all the guesswork for the collections agent.

With an accurate view on a customers data, a collections agent can have an honest conversation with a customer and come to a repayment agreement that is deemed fair by the customer and lender. Much of this process can be moved to digital channels to help save time for all involved.

With a wider range of accounts provided through Open Finance a more complete perspective can be attained. However, not having access to these accounts does not limit the success of such practice, it simply adds more to the picture.

Bank Account Verification

Bank account verification has been a sought-after service from larger organisations.

Although a more simple use of bank data, it does provide tremendous value to global businesses who, by nature, interact with thousands of individuals. Bank account verification allows any organisation to quickly and effectively ascertain that the information provided by a customer matches the bank account provided, validating ownership of that account.

For the gig economy organisations DirectID are working with, bank account verification proves that a single rider or driver owns the bank account they receive payments in. For organisations in financial services, the service can help derisk payments such as ACH payments in the US or EFP payments in Canada (debit initiated delayed payments that take 3-5 days to settle).

The larger an organisation becomes, the more difficult it is to adopt something that is innovative. Bank account verification can be the perfect first step for larger organisations who seek to utilise Open Banking services. This opens the door to more complex use cases that are likely to surge with the introduction of Open Finance data sets.

Moving from Credit Reference Agency (CRA) Data to Open Finance

The data provided by credit bureaus is incomplete and less appropriate for the world we live in. The adverse effect this has on both consumers and businesses is largely negative.

The pandemic has put pressure on credit risk processes that are underpinned by CRA scores, not just because they are historical by nature, but because the data is entirely regional.

Bank statement data is a universal constant from an existing trust network that can be leveraged to solve these pains. By introducing bank data to the decisioning process we can start to move away from a model that requires an individual to have credit to get credit.

We’re living in a more digital and global economy than ever before, so lenders need real-time indicators of credit risk to make better and faster decisions. As Open Banking expands to a wider range of accounts, the value gap between CRA data and Open Banking data will continue to grow.

Audience Questions for James Varga

Does the Regulatory Framework Review, the Smart Data Initiative & the new DCMS Strategic Digital Strategy really give us the opportunity to get to proper Open Finance that consumers can start to get properly engaged with?

James:

I think all these things are a strong step to providing a framework or ecosystem around consumer owned data. We saw a huge shift around GDPR for example – something taken as read now in the UK.

Every step, regulatory initiative, review, membership organisations, all goes towards reinforcing that the only way to support the world we live in is to flip the model – to put consumers in charge of their data.

10 years ago the idea of consumers owning their own financial data was foreign to most banks. Even 3-4 years ago I was in the board rooms of banks with people saying that Open Banking will never have traction because the data belongs to them.

We’ll start to see is more of a regulatory driven initiative, and more commercial opportunities as Open Banking lays the groundwork for this. We’ll see a lot of institutions offer data on a commercial basis – similar to what we’re seeing in the US. Banks will stop waiting for the regulations. They’ll see opportunity and start to provide this information into the market.

Transactions data can enable people who might not get a score using conventional predictors actually receive credit. This is a major advantage and is an aim in many policies like the FCA and SFE and many others.

James:

That’s one of the challenges around adopting bank data and using it in credit risk decisions – it’s a fundamental shift. Lots of businesses are still deciding on whether to give someone a loan based on general approaches to credit risk. For example, they may decline anyone with a score <500 without any real understanding of their current circumstances. Even opening a bank account could negatively impact this despite it having no impact on the ability to repay a loan.

Why are other markets so ahead with electronic identification?

James:

Our first product was a consumer owned and managed digital identity product that you could sign up for. At the time this included mortgages, savings, credit cards bank accounts, social accounts – adopting the Open Finance principle 10 years ago. One of the leading use cases in the identity industry has been bank ID in the Nordics, alongside Aadhar in India and the Estonia e-residency programme. These are great examples of industry and government coming together to bridge a gap. Different government and social structures have made it more acceptable there. The pressure we are seeing surrounding the identity use case is building and it can affect people in their everyday lives. To go to the recycling depot in Oslo you need to bring your phone with your e-identification to get access – but we still have a long way to go before we get there.

We are seeing more alternative data sources in regards to credit scores but CRAs are still using the same protocols for their ratings. How can this be reversed with Open Finance and having the credit institution embark on live data analysis for more accurate ratings and more inclusive credit funding?

James:

If you look at the UK market, 50% of the CRAs have made a meaningful step to including bank data into their decisioning and services they offer. This is great – but I don’t believe in a single credit score. There’s too many nuances and too many individual circumstances to come up with a single score. So, this presents a challenge to those businesses who have always relied on a single credit score.

If you look at the FCA and the emphasis they are putting on responsible lending, responsible gaming, and income verification, you really need to break these things into component parts to attain a holistic view.

I don’t think we should use Open Banking to enhance the single score model. Instead, we should use it to get more detail and real time understanding of an individual’s circumstances so we can better understand them and more effectively personalise products for them.

Read the original blog here.