E-commerce has grown significantly over the past years, with more and more purchases made online for a variety of products, ranging from necessary items, such as groceries, to convenience goods and electronics. The pandemic has pushed the industry even further, by placing requirements for contactless and cashless payments. One of the most talked-about trends that has had a substantial impact in the retail space is buy-now-pay-later (BNPL), the payment method that is thought to potentially surpass the big player Credit Cards. In order to give you profound insights about this new trend, Holland Fintech undercover team will answer the most relevant questions surrounding this payment method.

What is Buy now, pay later?

As the name suggests, buy now pay later allows consumers to receive an item immediately without having to pay upfront but instead, pay in installments with no interest. Typical advertisements for BNPL are “buy now and pay nothing for 3 months”, “12 months interest free”, or “installments with 0% interest.”

What companies are popular in providing this service?

According to Investopedia sources, the most popular BNPL service providers are: Affirm, Sezzle, Afterpay, Splitit, Perpay, PayPal Pay in 4, and Klarna. These providers differ from each other in the number of installments, late fees charge, and amount due at purchase. They are designed to tailor the purpose and financial situation of consumers, whether they are students, or working adults desiring for flexible payment plans, or groups that make small/large purchases.

What are the advantages of BNPL and why do people prefer it over credit cards?

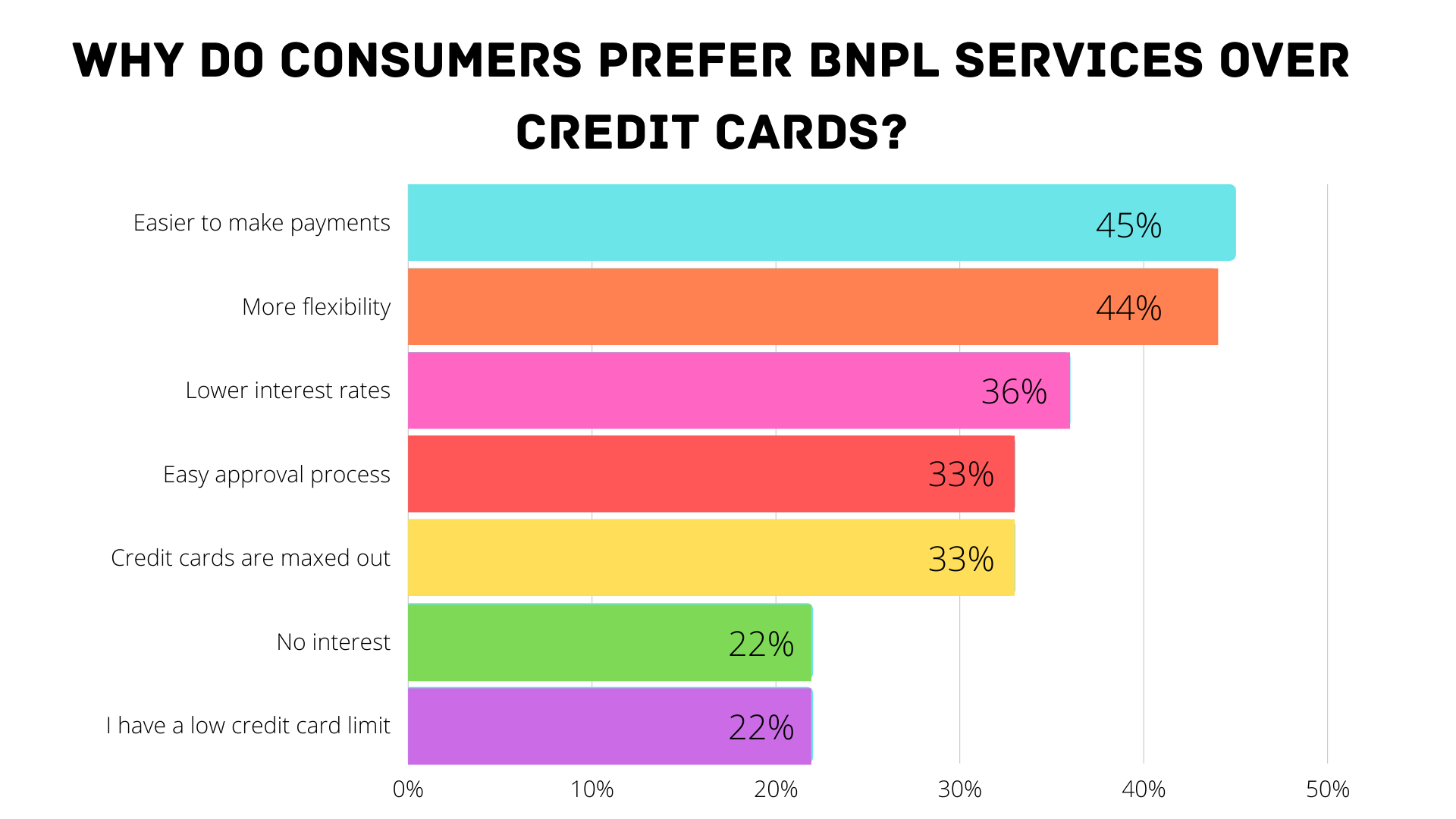

According to a survey by the Balance, conducted on more than 2,000 consumers to investigate their preferences between BNPL and Credit Cards, more than half (56%) prefer using a BNPL to pay over a more traditional credit card. When asked the reasons, respondents respond:

We’ve seen the advantages of BNPL from the consumer’s perspective. How about the sellers/retailers?

- Profit. Consumers can spread payments over time, which makes products more affordable and results in more sales for sellers. Companies have reported that more than 30% increases in average order value as a result of Buy Now Pay Later solutions.

- Increased referral traffic. By adopting this payment method, companies are added to the list of BNPL platforms and exposed to many users who are new to their brand. For example, firms such as Afterpay advertise partner brands in their directories and lead shoppers to brands which they probably have never heard of before.

- Increased responsible customer base. One important remark when using the BNPL service is that users always have to complete their installments on time, otherwise, they will have to pay a really high penalty. The business is highly built on trust and stores particularly rely on the responsibility of consumers. If sellers can build a large responsible customer base, the business journey will be much easier if companies can maintain their loyalty.

What are the disadvantages of BNPL?

Everything has pros and cons and there is no exception for BNPL.

- Heavy penalty: If consumers fail to make payments on time, they will potentially incur large costs in a short period of time.

- Unnecessary spending: The payment flexibility and product affordability certainly encourages consumers to make more purchases. On the one hand, it is amazing for sellers to gain profits from surplus sales. On the other hand, buyers are more likely to spend more than their initial intention. It is reported that almost 60% of consumers admitted they bought things they wouldn’t have otherwise purchased if they’d had to pay it all upfront.

- Lack of regulations: It’s well known that the business is operated on trust and responsibility of consumers but the question of how to make sure that consumers pay on time, or how to ensure that they even pay back, is hardly answered. Opponents of this trend believe that there is not enough regulation to control buyers’ paying capability. Companies such as Afterpay assess users’ responsibility by requesting them to make the purchase for the first time to prove that they are able to pay on time. If consumers are proven responsible overtime, the limited purchases will be extended. However, this method may not guarantee accurate results in the long run since that people being responsible now doesn’t mean that they will be responsible in the future.

- Vulnerable groups: Easy approval process means that vulnerable groups, including low-income customers (e.g: students, teenagers) will also use this service. The consequences of purchasing out of spontaneity is far more serious for these groups because they are more likely to get themselves into financial difficulties.

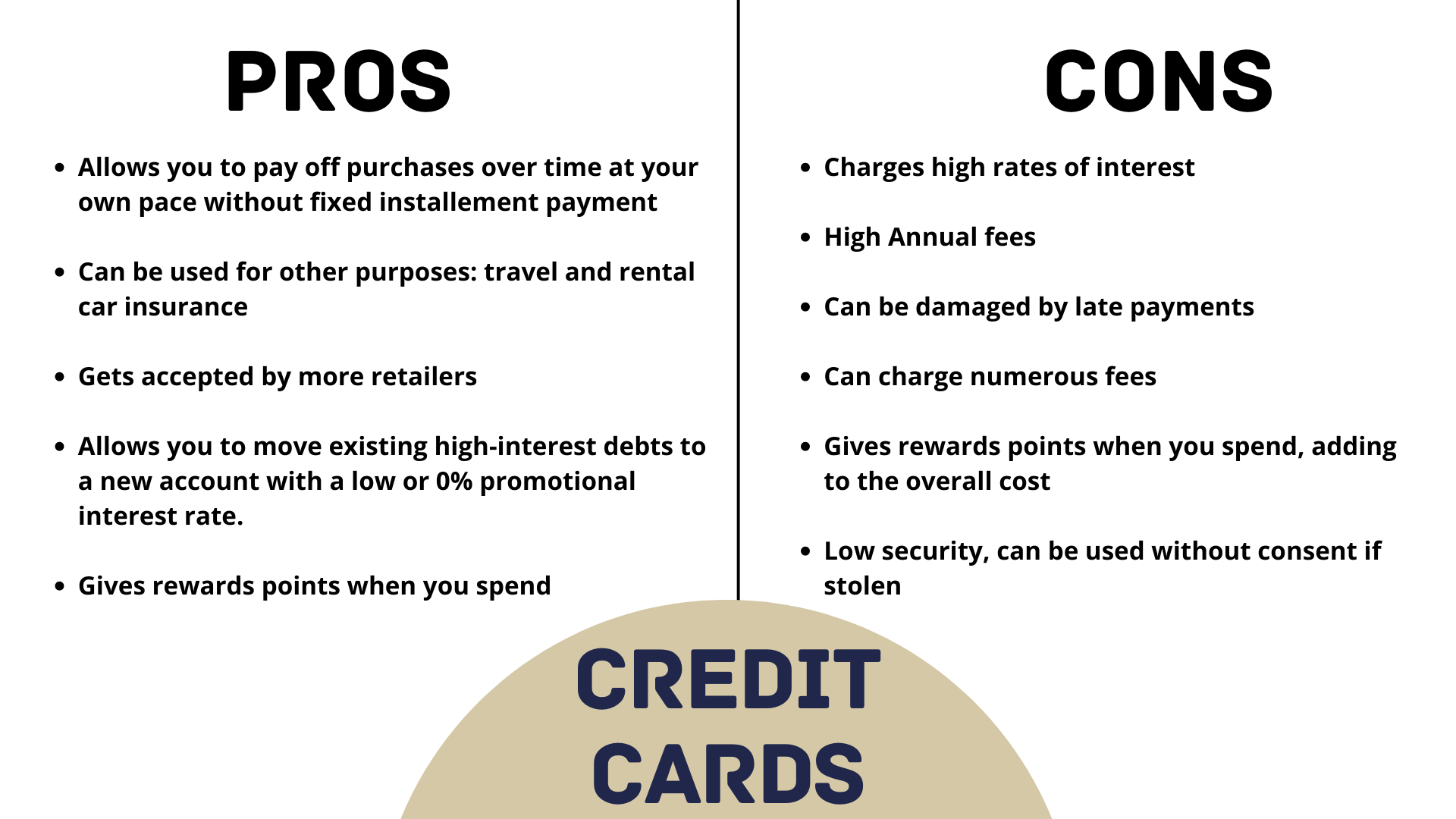

As we are comparing BNPL with Credit Cards, let’s take a closer look at pros and cons of credit cards as well. We only listed the relevant advantages and disadvantages below so you can easily compare BNPL and Credit Cards. If you want more details about Credit Cards, read the full list here.

Will BNPL take over credit cards in the next 3 - 5 years?

According to a poll participated by more than 1600 people on LinkedIn, 53% said yes, 27% said no and 22% said it’s too early to call…

Interesting insights for this topic: Credit cards companies can totally flip the game by extending features, like by having a no interest rate for lower amounts. By doing it this way, they might gain back the piece of cake from BNPL.

Talking about strategies for credit cards, there is the need to remove payment friction to come at par with the BNPL providers.

Insights from Don Ginsel, Founder and CEO of Holland Fintech:

“The space for consumer credit is always debated, as it has the potential to give people access to goods they can not yet afford, but misuse and over indebtment is a closely associated risk. BNPL makes credit even more accessible, as it is available right at the purchase and at very low costs - as long as you pay in time. It may even remove the realisation of having debt. The latter is the key challenge to solve, especially for the most vulnerable groups: how do we help people keep an overview of their income, obligations and spending behavior.”