Running a business requires access to banking services and, in the past, this has given traditional banks a strong position in the small business segment.

Those same banks have also benefited from a respected position of trust to keep money and data safe.

Increasingly, however, trust is a more nuanced concept. Small business owners expect more than safety; they want customer-centricity and support through the good times and bad.

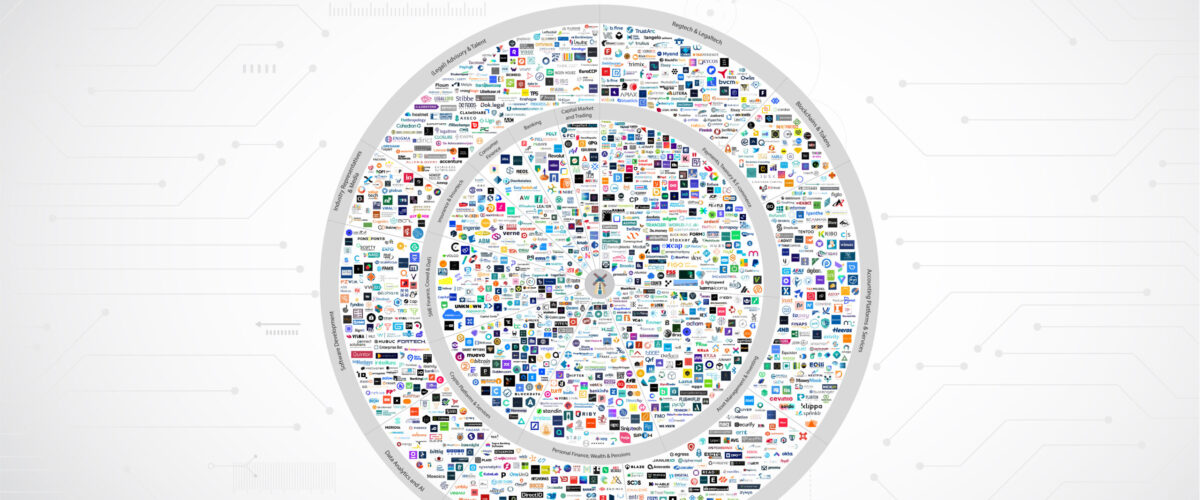

Small business banking is the new battlefront for the banks and the fintechs

According to global EY research published earlier this year, 56% of SMEs are planning to change their business model, something that EY calls a “watershed moment.”

Interestingly for Australia’s growing open banking ecosystem harnessing the power of the Consumer Data Right (CDR), the same EY report states that 82% of SMEs are interested in sharing data, especially if they get a personalised benefit, in other words something that genuinely saves them time, money or hassle. Moreover, some 50% of SMEs would be prepared to pay for this benefit!

With banks not currently best-equipped to focus on the real needs of SMEs due to product-centricity, compliance, cost-focused decision-making processes, and legacy technology, a range of challengers see an opportunity to deliver better products and services to this underserved market segment.

In Australia, an ever-growing number of neobank and non-bank entities are entering the small business banking value chain or expanding across it leveraging a pre-existing relationship. Some challengers are looking to pick off profitable business lines like lending. Others are positioning themselves as the primary interface through which a business owner manages their financial affairs, especially invoicing, payments and reconciliations.

For example, in Australia here are just some of the contenders:

-

Neobanks – Avenue, Judo and Revolut

-

Fintechs – Archa, Cape, Parpera and Prospa

-

Paytechs – DiviPay, Paytron, Zeller and Zepto

-

Accounting platforms – Xero, MYOB and QuickBooks (and all the rest!)

I’ve previously predicted that small business banking will be the new battlefront for the banks versus the fintechs, and in 2022, I can see that competition in small business banking is about to ramp up exponentially.

How will this impact the banks?

For the banks, this increased competition presents a clear risk to revenue.

Responding to these challenges will require new thinking, particularly in moving from a focus on selling products towards helping clients meet their day-to-day business needs.

Open banking is now picking up pace in Australia and will be a catalyst for change as fintechs access bank data to generate insights and increase personalisation. The Australian Government has also recently confirmed its agreement to the CDR being extended to action initiation including open banking payments.

But open banking is not the only factor the banks need to consider.

These challengers are digital-first, and born in the cloud, with all the advantages that come with that in terms of speed, convenience and cost. Fintechs can offer a winning combination of features, insights, digital experience, and lower fees.

The banks can see all this. They also know that their small business customers are unhappy with high fees, a lack of features and slow customer service. What the banks are struggling to see, is a way to beat the fintechs at their own game. Despite their bountiful financial and human resources, most banks are still struggling to innovate.

What do small business customers really need and want?

Research we’ve studied at BankiFi lists what small business customers wish their bank would stop doing, and what they wish their bank would start doing.

What customers don’t want includes:

-

Fees are too high

-

Long payments processing times

-

Bad customer service

-

Inadequate security measures

What customers do want includes:

- Ability to manage and categorise expenses

- Automatically set aside funds for GST

- Automatically set aside funds for a liquidity buffer to avoid having to borrow at the last minute

- Really good mobile app and digital experience on par with “big tech”

- Easier invoicing and payments and reconciliations including integrations with bookkeeping/accounting software, plus

- Getting paid faster

With a growing portion of the small business segment being micro businesses, including gig economy workers, there is acute sensitivity to the timing of payments.

In a nutshell, small business owners want more value from their existing banking channels and they want it to align easily with their business’s workflows.

Banks need to respond.

_____

Read the full article here.