For this week’s research article, we dive into new insights on fintech market, banking, insurance, payments, trends, diversity in fintech and more. Happy reading!

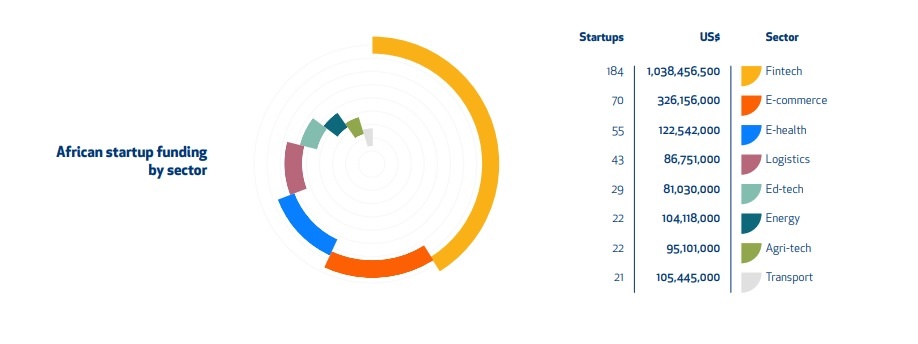

50% of African tech’s $2bn funding pot went to fintech startups in 2021 (Disrupt)

According to the seventh edition of our African Tech Startups Funding Report, which is available free to all as part of an open-sourcing initiative in partnership with Novastar Ventures, MFS Africa, Quona Capital, 4Di Capital, MEST Africa and Future Africa, 564 African tech startups raised a combined US$2,148,517,500 in 2021. More so than ever before, fintech is the most popular sector for investments. An extraordinary year saw new unicorns minted, round size records tumble, and fintech startups break the US$1 billion funding barrier, something the African tech space as a whole only managed for the first time in 2021. Read more.

ZeroFox Releases 2022 Forecast Report Anticipating Increases in Ransomware, Third-Party Compromises and Malware-as-a-Service (Yahoo)

ZeroFox, a leading external cybersecurity provider, published the “2022 Threat Intelligence Forecast,” detailing expected cybercriminal behavior trends including ransomware, malware-as-a-service, vulnerabilities and exploits. Within the report, the ZeroFox Intelligence team reviews 12 months of threat actor activity from 2021 and provides go-forward recommendations for security teams as we continue into 2022. Key takeaways include an assessment of increasing ransomware threats targeting the financial, manufacturing, retail and healthcare sectors, a predicted surge in data kidnapping attacks, and a continued upward trajectory of third-party compromises targeting vendors within larger supply chains. Read more.

A deep dive into the world of climate fintech with firstminute Capital (Maddyness)

Climate change poses substantial economic and political risk to the global economy. Efforts to mitigate such risk will require a fundamental retooling of our global economy and coordinated action across public and private stakeholders. Financial services institutions play critical roles, however incumbents in banking, insurance and finance are slow to innovate. Their legacy technology infrastructure and business models don’t lend themselves to iteration and innovation. Conversely, fintech has shown its ability to drive innovation and to reach venture scale. Financial product innovation and applied technologies such as big data, artificial intelligence, distributed ledger technologies make capital availability, data gathering and processing much faster, transparent and cost effective. As a result, they have important roles as enablers and disruptors within climate change. Read more.

Startups raised $7.2 billion during Q4, 2021; Fintech most funded sector: Nasscom-PGA Labs report (Business Today)

The December quarter continued to witness the strong investment momentum of startups with a cumulative funds-raise of $ 7.2 billion during the Q4, CY2021, a growth of 18% q-o-q. as per a report by NASSCOM and PGA LabsThe December quarter, 2021 minted 14 unicorns . FinTech gained further traction and remained favorite among global investors community, the report stated. The number of deals closed in Q4, CY21(184) increased by 52% when compared to Q3 CY21 .A large part of the investments was driven by the large deals with a size of$ 100 million and above which constituted 68% of the total funding . Approximately 92% of the funding activity was driven b ygrowth-stage and late-stage deals, as per the report. Read more.

Why Decentralised Finance (DeFi) Matters and the Policy Implications (OECD)

The growing application of Decentralised Finance or DeFi and its increasing interconnectedness with traditional markets presents an urgent challenge for policy makers, as DeFi applications give rise to important risks and challenges for participants and the markets. This report provides an explanation of DeFi and its applications and then describes the evolution of DeFi markets to date. It explores the benefits and risks of DeFi and the DeFi/CeFi intersection and puts forward policy considerations. Read more.

—

Do you have any news to share: please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here.

In order to see our other weekly highlights, check out the following links: analysis & opinion.