For this week’s research article, we dive into new insights on fintech market, banking, insurance, payments, trends, diversity in fintech and more. Happy reading!

Open finance set to benefit New Zealand consumers - report (ITbrief)

Open finance is expected to become the standard for consumers’ financial welfare and empowerment, according to an Aotearoa fintech research report. “The huge opportunities for Kiwi businesses and consumers can’t be ignored, with open finance set to increase competition and innovation across many sectors,” says FinTechNZ executive director, Jason Roberts. “We’re in a perfect position, with open finance in its infancy, to leverage this technology to help contribute to reducing financial exclusion and lay down the foundations for a strong digital economy. Open finance, if done right, provides an enormous opportunity to address inequities, both now and in the foreseeable future, helping Kiwis better manage their finances.” Read more.

How Does SEO For Fintech Work? - Things To Consider (Finextra)

Competition and rapid change characterize the fintech sector. To succeed in the financial market, a new company must be able to distinguish itself from the established players and maintain an advantage over them. Using SEO and digital marketing approaches that may effectively promote a brand, widen a client base, and build consumer confidence, a new firm can do this. The startup may have a difficult time overcoming this challenge if they do not know where to begin or what strategies to use. Read more.

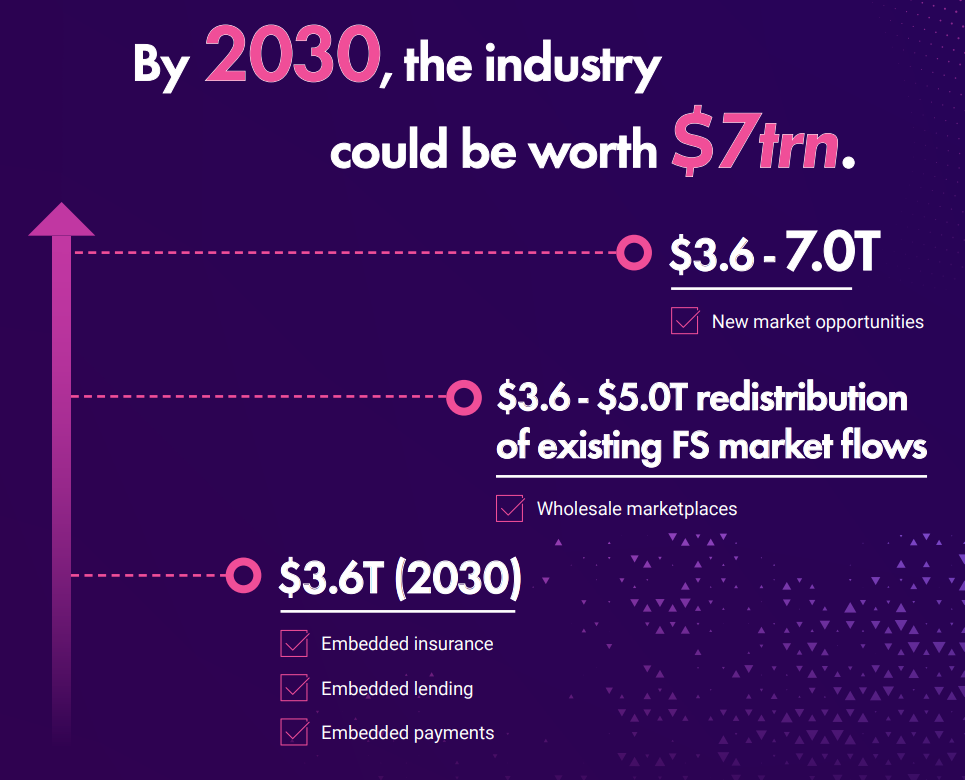

APAC Has a Huge Appetite for Banking as a Service, Finastra Research Shows (Fintech News)

Financial services software and cloud solutions provider Finastra’s research found that APAC’s appetite for Banking as a Service (BaaS) exceeds that of EMEA and the Americas. The report found that 88% of senior executives across APAC in a number of sectors (including banking, healthcare, retail and technology) said they are already implementing BaaS solutions or are planning to, compared with 80% in EMEA and 87% in the Americas. The research “Banking as a Service: Outlook 2022 | Paving the way for Embedded Finance” canvassed the opinions of 1,600 senior industry executives, exploring the opportunities presented by Banking as a Service (BaaS). Read more.

More Than 90% Of European Fintechs Will Adopt AI-Enabled Risks Decisioning To Combat Fraud (Mondovisione)

According to the latest study from Provenir, a global leader in AI-powered risk decisioning software for the fintech industry, fraud prevention is the biggest driver for investments in AI-enabled risk decisioning this year. The survey, which canvassed the views of 100 decision-makers from fintechs and financial services firms across Europe, found that other major drivers for investments in AI-enabled risk decisioning include automating decisions across the credit lifecycle (68%), competitive pricing (65%) and cost savings and operational efficiency (61%). Read more.

The systemic risks and vast opportunities in fintech (Fintech Futures)

Technology has made the world a smaller place. In the ‘Global Village’, netizens in one country can influence the stock market in another, national regulations can choke international innovation and nimble tech start-ups can usurp legacy financial institutions. In this dizzying new world, where the links in the chain seem to stretch into the infinite, one small shock to the system can have a multiplying effect across the entire network. But there are opportunities, too. The democratisation and decentralisation of finance promise participation for ordinary people, for example. Read more.

—

Do you have any news to share: please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here.

In order to see our other weekly highlights, check out the following links: analysis & opinion.