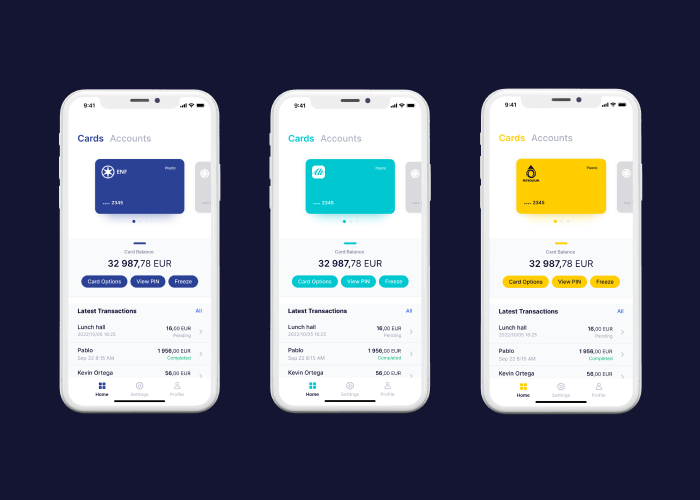

MyApp, complementing Enfuce’s turnkey solution Card as a Service, is a white-label mobile app with all the features of a modern card management. With MyApp, Enfuce now allows its customers to move to market with their new payment products in a more complete form.

The advantage of a white-label app is that it saves time and money for app development. MyApp is developed, released, and maintained by Enfuce which means that no resources are required from the customer to either build or keep the app up-to-date and secure. The business can concentrate on their payment product and let Enfuce help to launch the app in as fast as in 8 weeks.

“Mobile apps are today seen as a mandatory part of any card product. We don’t want it to be a constraining factor for our customers. Instead, we help them with our development. MyApp supports our customers when they want to test their new products on the market with the features and branding they choose,” says Matti Rusila, Director of Product at Enfuce.

Being a white-label app means that MyApp is easily rebranded with logos, colours, and fonts. The business can also select the languages and features they want for their customers.

MyApp, available on both Android and iOS, is simple to use. It gives the end-customers an easy control of their card and makes it possible for them to limit card usage and geoblocking, view PIN and other card details, report a lost card and freeze it, and to add the card to digital wallets. Transaction push notifications bring safety and transparency to card usage.

For further information

Matti Rusila

Director of Product

[email protected]

+358 40 6325800

About Enfuce

Enfuce offers payment, open banking and sustainability services to banks, fintechs, financial operators, and merchants. By combining industry expertise, innovative technology and compliance, Enfuce delivers long-term and scalable solutions quickly and securely. Founded in Finland, Enfuce recently expanded its geographic presence in the UK, Germany and France and has over 16 million active card users on their platform from whom Enfuce processes close to €1 billion transactions annually.

Enfuce has raised multiple rounds of venture capital funding and has been recognised by e.g. TheFinTech50, Visa Fintech Fast Track programme, Mastercard Lighthouse Development Programme, Deloitte Technology Fast 50, and as winner of the 2019 PayTech Award for “Best Payments solution for Payment Systems in the Cloud”.

For more information, visit www.enfuce.com.