Fraudio will be exhibiting at Money 20/20 ; Visit our booth F132, Hall 7

Netherlands, Money 20/20 – June 6, 2022 – Fraudio, a payment fraud detection and anti-money laundering (AML) solution provider, is partnering with Kenbi Authorize More, developer of an AI platform that helps global merchants and card issuers approve more transactions. The partnership will help solve transaction declines caused by lack of data available in real-time to issuers when approving or declining e-commerce transactions based on fraud risk.The partnership will enable issuer banks and merchants to reduce false positives and maximize conversion rates, all in real-time.

A significant percentage of online purchasing is declined by issuer banks due to the risk of fraud. Although many merchants use advanced anti-fraud monitoring systems utilizing a large data set to eliminate fraud at an earlier stage, those supplementary analytics are not shared with the issuer as part of the transaction details. By accessing AI-enriched merchant data in real time, issuers can make smarter decisions and avoid false declines.

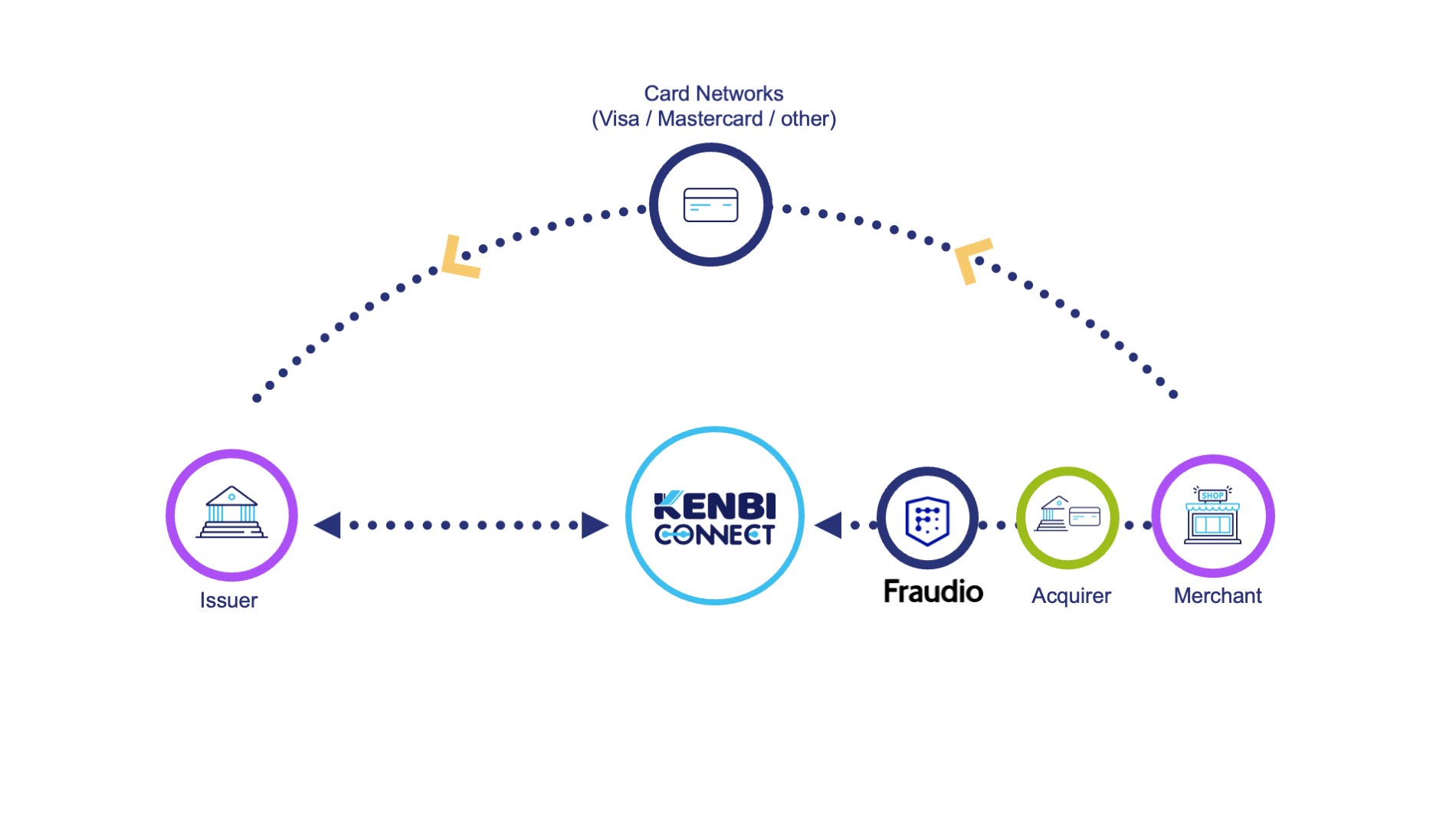

Merchants can sign up to the Kenbi AI platform easily and configure their collaboration policy. Fraudio then shares – in real time – the AI enriched transaction data with the issuer through Kenbi connect platform. The merchant policy can be updated at any time using the Kenbi AI platform.

Chanan Lavi, Kenbi CEO and Co-Founder, explains; “We believe in collaboration, in sharing data and connectivity, and in saying ‘yes’ to legitimate transactions. Partnering with Fraudio, who shares our goals, will enable us to provide intelligent data, collected and analyzed by their AI through Kenbi’s platform, directly to issuer banks.”

Gadi Erel, Fraudio VP Global Sales, adds: “This partnership unlocks the ability to increase both the merchant and the issuer acceptance rates using enriched data to make decisions that benefit each business’s bottom line. And of course, this results in providing the consumer a better, more frictionless experience.”

About Fraudio

Fraudio is a leading payment fraud and money laundering detection company founded by online payment and AI experts in 2019. Its mission is to connect all companies in the payments ecosystem to a powerful centralized AI that detects and prevents fraud in real-time, creating unrivaled value. Fraudio leverages the latest in technology and data science innovations to create highly scalable cloud-native API solutions. It is trusted to protect and enable the safe scaling of some of the fastest-growing payment companies in the world, such as Viva Wallet, SaltPay, Paymentology, Tutuka, Switch, Payabl, ePayco, Bold, Culqi, and PagueloFacil. Learn more: www.fraudio.com

About Kenbi

Kenbi is a global fintech innovator enabling issuing banks and merchants to jointly win back legitimate transactions that are currently being declined. Kenbi’s AI-driven technology optimizes the traditional payment model for increased revenue, customer satisfaction, and loyalty. The company’s solution leverages the aligned interests of issuing banks and merchants to authorize more legitimate transactions by providing an automated and seamless system that shares rich data points and splits the risk costs in real-time based on predefined risk profiles and rules. Kenbi’s founders and team members are fintech veterans and payment optimization professionals. To find out more: www.kenbi.io.