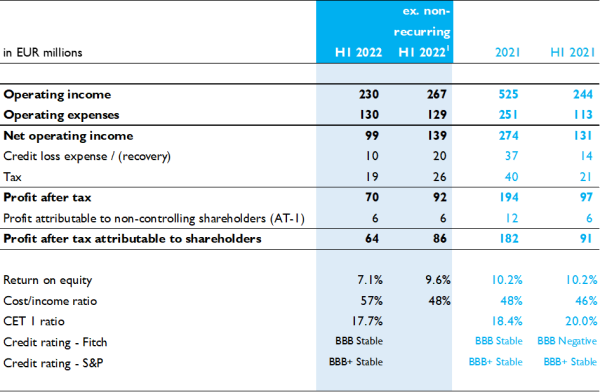

Business and financial highlights

- NIBC had a strong half year with an underlying net profit of EUR 86 million (H1 2021: EUR 91 million) before a non-recurring net loss of EUR 22 million related to the sale of non-core portfolios.

- Strong performance of the core portfolios:

- Mortgage portfolio grew 9% to EUR 24 billion, including Originate-to-Manage business

- Asset-Backed & Specialty Finance segment increased by 15%

- Platforms Beequip and yesqar showed 23% growth

- Interest income equals EUR 209 million (+11%), driven by positive developments of our portfolio volumes

and funding costs. - The cost/income ratio of 48% includes continued investments in our IT environment, process improvements

and strategic projects. - Credit losses amount to EUR 20 million in H1 2022 (from EUR 14 million in H1 2021), including an additional management overlay of EUR 5 million.

- Strong capital position with a CET 1 ratio of 17.7% (2021: 18.4%), absorbing new regulatory requirements

and an ROE of 9.6%.

Statement of the CEO

“Looking back at the first half of 2022, I am pleased to report a strong performance. Our sharpened business strategy allowed us to continue to deliver upon our promises, despite the increasing global political and economic uncertainty. The war in Ukraine has impacted the global economy in various ways. Delays in the global supply chain, tight labour markets, shortages in commodities and spiking energy prices have led to new challenges for governments, monetary authorities, businesses and households. Based on these changes in economic outlook, markets have reset long-term interest rate levels and monetary authorities have changed their policy stance to curb the rapidly increasing inflation, bringing short-term interest rates back into positive territory.

In this challenging environment, we continued to be an entrepreneurial financing partner to our clients, illustrated by strong growth of our core portfolios. Over the first half of 2022, we saw our mortgage loan portfolio grow with 9% to EUR 24 billion. Our continued investment in client service is being recognised: both NIBC Direct and Lot Hypotheken have been awarded ‘best mortgage lenders of 2022’. At the same time, we saw an increase of 15% in our Asset-Backed & Specialty Finance segment driven by a strong origination in all asset classes. Our businesses Beequip, the largest alternative financier of equipment in the Netherlands, and yesqar, a financier to the automotive businesses, continued their strong growth with a year-to-date increase of 23% of the portfolios. With this basis, we delivered a healthy underlying net profit of EUR 86 million (2021: EUR 91 million), before a non-recurring net loss of EUR 22 million related to the sale of two non-core portfolios, a major step in further de-risking the bank’s balance sheet.

All in all, I’m proud to say that these strong results confirm that our targeted strategy is paying off. We reinforced our position providing asset financing to both individuals and companies ranging from private housing to rental property, commercial real estate, vessels, infrastructure, cars and equipment. In line with the execution of our strategy, we have sold our Offshore Energy and Leveraged Finance portfolios. Going forward, we are carefully reducing our remaining non-core portfolios, in active dialogue with our clients.

As sustainability is core to our targeted strategy, we continue to actively manage our ESG profile. We are well positioned to contribute to a more sustainable, resilient and inclusive future for the communities we serve. In the first half of 2022, we have sold our Offshore Energy portfolio, taking an important step towards our net-zero ambition by putting our promises in the Climate Action Plan into practice. Our ‘green’ mortgage label Lot Hypotheken was nominated for the SEH Sustainability Award, as one of the most progressive mortgage lenders to actively incorporate sustainability into its mortgage policy. In April, our North Westerly CLO VII was awarded ESG Deal of the Year. Through all these steps, we continue to align our activities and portfolios with our overall business strategy, which integrates a balanced ESG approach.

I look forward to working with Anke Schlichting, who was appointed Chief Technology Officer and member of the NIBC Managing Board in July this year, as we believe that in today’s tech-driven world, IT and Operations require a separate position at the most senior level of the bank. Anke has extensive experience in and in-depth knowledge of IT and Operations.

I am grateful for the commitment and dedication of our people towards their work and our clients. The past months have been demanding for our people as well as our clients. Looking ahead, economic conditions are likely to remain challenging. Nevertheless, NIBC is well-positioned to face these challenges and continue the execution of its business strategy as a focused asset-based financier. Supported by our ‘Think Yes’ mentality, the entrepreneurial spirit of our people and today’s results, we are moving into the second half of 2022 with confidence. We will continue to be there for our clients, now and in the future.”

NIBC Holding N.V. – Key Figures

1 Excluding a non-recurring net loss of EUR 22 million related to the sale of two non-core portfolios.

We refer to our Interim Report 2022 NIBC Holding N.V. published on our website or full details.

_____

For more information, please refer to our website www.nibc.com or contact:

| Martin Groot Wesseldijk Press Relations T: +31 70 342 5418 E: martin.groot.wesseldijk@nibc. | Eveline van Wesemael Press Relations T: +31 70 342 5412 E: [email protected] | Toine Teulings Debt Investor enquiries T: +31 70 342 9836 E: [email protected] |