The fintech industry is rapidly evolving and disrupting traditional financial systems. In this article, we bring you the latest research insights to help you stay ahead of the curve and understand the future of financial technology. Enjoy researching!

Finnius Outlook 2023 (Finnius)

Financial regulatory law is complex. It is comprehensive, it is complicated, sometimes incomprehensible, and it

can also be frustrating. Fortunately, regulatory law is also interesting and dynamic. And it is socially relevant. The

combination of all these facets drives us to provide a very thorough overview of financial regulatory law once a year.

Making the rules accessible and practical is our goal, in our daily services and also in this annual Outlook. The report covers: The breakdown in parts is by type of market party or service, so you quickly get to where you need to be; The Integrity and Sustainability specials, have been among the most comprehensive sections for several years now; Each development is represented by briefly explaining what it concerns, to whom it is specifically relevant, and when exactly it comes into play; Very important or noteworthy developments are discussed in a little more detail. Read more

Crypto Fraud Continued Drastic Rise in 2022; Reveals CoinJournal (The Fintech Times)

The cryptocurrency market as a whole has not experienced the best PR in the last 12 months. After crypto exchange FTX filed for bankruptcy in November, there have been enhanced calls for increased regulation in the space. Such news has also not been the only source of bad news for the crypto industry. As the number of investors in the space has risen, so has the amount of fraud experienced. A study of crypto fraud, detailed by CoinJournal, shows the extent to which it has grown year-on-year. The research looks at the impact of cryptocurrency fraud since the beginning of 2011. 2022 emerged as the worst year currently on record for crypto fraud. There were 120 different incidents occurring during the year. The number represents a 28 per cent rise compared to 2021. Despite this worrying statistic, the total value lost across all incidents in 2022 was less than half of that of 2021. Read more

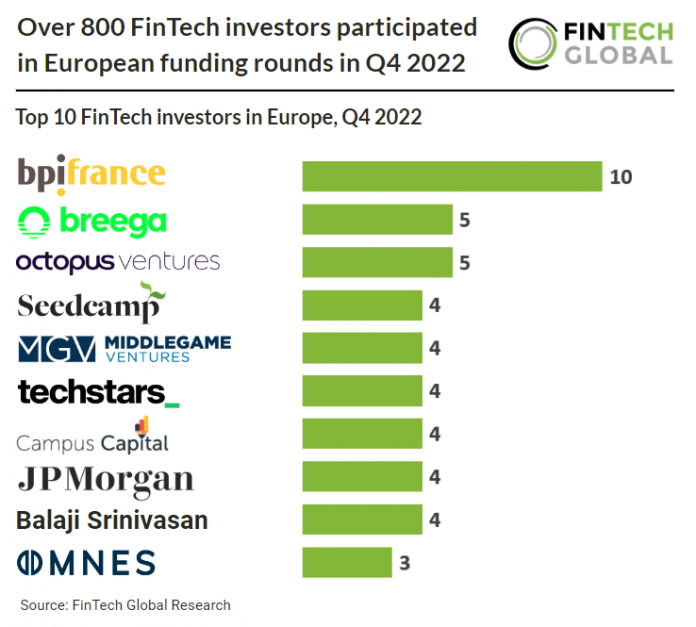

Over 800 FinTech investors participated in European funding rounds in Q4 2022 (Global Fintech)

In total 863 unique investors participated in European FinTech funding rounds during the fourth quarter of 2022. Total capital invested in European FinTech companies reached $2.8bn in Q4 2022, a 33% drop from the previous quarter. European FinTech deal activity in Q4 2022 increased a modest 2.7% from Q3 levels reaching 371 deals in total during Q4. The UK was the most active FinTech country in Europe during Q4 2022 with a 31% share of total FinTech deals. France was the second most active with 15% and Switzerland was third with 8%. The data for this research was taken from the FinTech Global database. Read more

Is the UK at risk of losing its leading position in open banking? (Global Fintech)

A new report has claimed that the UK could lose its position as the global leader in open banking unless drastic action is taken. A report released by Open Banking Excellence – the Global Open Finance Index – is a data-driven exploration of the global state of Open Banking featuring insight from industry experts from 23 countries. The report found that while the UK was still seen as a global leader, countries like Brazil, Singapore, India and Australia were moving faster and are likely to eclipse the UK in the near future. Another key finding was that whilst regulatory mandates help nascent ecosystems to establish themselves, it is fundamental that the participants find mutually beneficial arrangements beyond the mandates in order for the ecosystems to thrive. Read more

Dutch Fintech Map 2022 (Holland Fintech)

Since 2014, Holland Fintech has been mapping the fintech landscape, in the Netherlands and abroad. The growth has been explosive. In 2014, the fintech map contained 134 companies that were active in the Netherlands. Today, there are 1763 companies on the map. This year’s report really shows how far we’ve come as a country when it comes to fintech. Download for free the full report here

–

Do you have any news to share: please put feed@hollandfintech.com on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion