The fintech industry is rapidly evolving and disrupting traditional financial systems. In this article, we bring you the latest research insights to help you stay ahead of the curve and understand the future of financial technology. Enjoy researching!

New York Fed and Monetary Authority of Singapore Publish Results of Joint Wholesale Cross-Border Payments Research Study (Monetary Authority of Singapore)

The Federal Reserve Bank of New York’s New York Innovation Center (NYIC) and the Monetary Authority of Singapore (MAS) today published a research report detailing the results of the joint Project Cedar Phase II x Ubin+ (Cedar x Ubin+) experiment. The Cedar x Ubin+ experiment examined whether distributed ledger technology (DLT) could be used to improve the efficiency of cross-border wholesale payments and settlements involving multiple currencies. The technical research experiment built on previous phases of the NYIC’s Project Cedar research and the MAS’ Ubin+ initiative. It examined a cross-border multi-currency use case in which vehicle currencies are used as a bridge to exchange currency pairs that are not widely traded. Read more

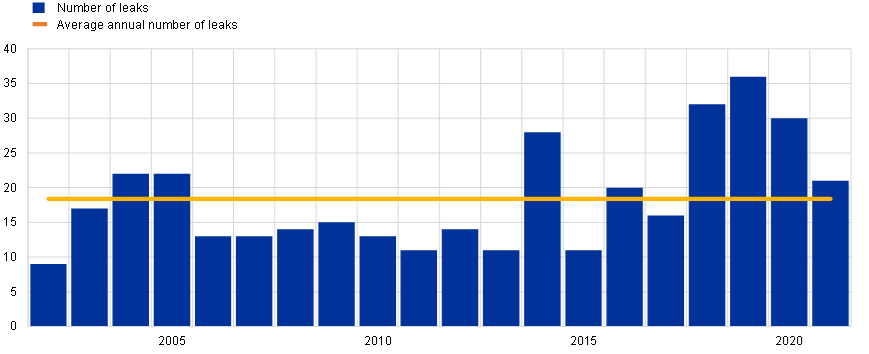

Anonymous Eurosystem leaks – minor nuisance or major problem? (ECB)

The effects of unattributed communication about monetary policy are not well understood. They may, for instance, move markets in the run-up to policy meetings and thereby reduce policy flexibility, or more generally harm a central bank’s credibility. To study their possible impact we identified and analysed 368 leaks from Eurosystem insiders from 2002 to 2021. Findings shows how the number of leaks each year has evolved over time. In the second half of the sample, we observe many more leaks on average, but see a decline in 2020 and 2021. The data also reveal a change in the typical timing of leaks. In the early years of the ECB’s monetary policy, leaks occurred almost exclusively before Governing Council meetings, while there has more recently been a substantial increase in post-meeting leaks. Our analysis furthermore shows that leaks are more frequent when the policy debate is more controversial – i.e. when there may be significant disagreement among policymakers. Read more

UK Finance research: 2022 fraud losses exceed GBP 1.2 bln (The Paypers)

UK Finance has released its Annual Fraud Report in partnership with Feedzai showcasing that financial fraud losses in the UK throughout 2022 exceeded GBP 1.2 billion. The Annual Fraud Report details the money amount reported by UK Finance members as stolen by criminals through financial fraud, with more than GBP 1.2 billion having been stolen through authorised and unauthorised fraud, equivalent to over GBP 2,300 every minute. This amount sees an 8% decrease from 2021, with the number of fraud cases across the UK having gone down 4% to approximately three million cases. Read more

Opportunities and risks of the digitalising insurance market over the next decade (AFM)

Increasing digitalisation is going to have an impact on the insurance sector and its supervision. Insurers are gathering more and more data and applying advanced data analysis techniques. This is also changing their operational management and distribution processes, from pricing to claims settlement. The main technological trends range from growing data volumes and more powerful analytics to increasing connectivity. Techniques to access and share data create opportunities for new partnerships and services that were previously impossible. Read more

Moving forward on data free flow with trust (OECD)

This report uses business consultations to investigate private-sector views on privacy and data protection rules for cross-border data flows. It aims to inform a more comprehensive understanding of challenges and ways forward for the policy agenda of ‘data free flow with trust’. While frameworks aimed at generating trust and facilitating data flows build on commonalities and elements of convergence, businesses identify challenges to fully operationalise them at the global level. In particular, businesses indicate the need for coherent principles and rules that are transparent and predictable, provide a practical balance between certainty and flexibility, and offer solutions that match business realities. Finally, the report highlights the need for greater international regulatory co-operation and leveraging the full range of options to uphold trust around privacy and data protection globally. Read more

–

Do you have any news to share: please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion