The Dutch Startup Ecosystem is witnessing a vibrant period of growth and investment, as highlighted by the recently released Quarterly Startup Report. Collaboratively prepared by Dealroom.co, Golden Egg Check, KPMG, the Regional Development Agencies (ROMs), Dutch Startup Association (DSA), and Techleap.nl, this report offers valuable insights into the funding landscape for Dutch startups during the second quarter of 2023.

Positive Upward Trend in Investments

The report reveals a positive trend in startup investments, with Dutch startups securing approximately €525M in venture capital in Q2 2023. This marks an increase compared to the previous quarter’s funding of €420M while representing a decrease from the same period in 2022 when investments reached €710M. Despite the relatively stable number of deals, this increase in investment signifies growing confidence in the Dutch startup ecosystem.

Prominent Sectors: Biotech, Fintech, and Cleantech

Biotech takes center stage in Q2 2023, with Tagworks leading the way by securing the largest investment of nearly €60M. VarmX, another notable biotech company, also secured a spot in the top ten deals. The top three investments are complemented by fintech companies Factris and Fourthline. Additionally, the cleantech sector emerged prominently, with companies like E-magy, HeatTransformers, and Pryme accounting for a combined total of €33M in the top 10 deals. Investments in AI-related startups accounted for 10% of the deals and 15-20% of the total investment amount.

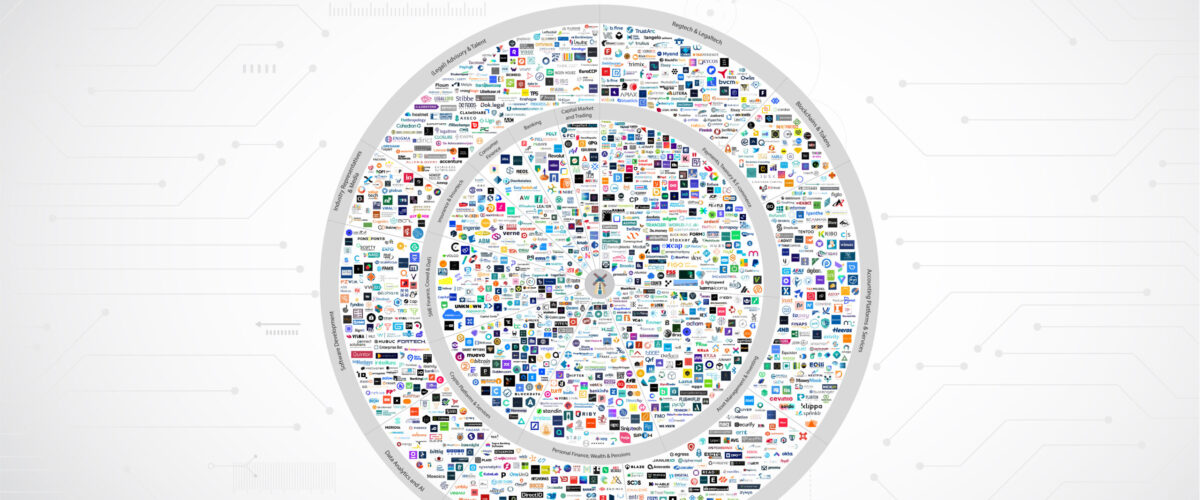

Fintech’s Role in the Dutch Startup Ecosystem

The Netherlands has established itself as a fertile breeding ground for fintech startups. Recently, six fintech CEOs called for more favorable conditions to maintain the attractiveness of the Dutch ecosystem. The fintech sector plays a vital role in enhancing accessibility to financial services and empowering consumers, contributing to the transition towards a sustainable economy. The report emphasizes that sustaining the Dutch position necessitates continued commitment to innovation, talent, cooperation, and support from the government and regulators.

Top Deals in Q2

Q2 2023 witnessed several notable investment deals, with Tagworks securing the highest investment of €59.5M. Other significant deals include Factris and Fourthline, each receiving €50M, and Weaviate.io and Axelera AI securing $50M (including a €27M round announced in 2022). VarmX secured €30M, while E-magy, HeatTransformers, Instruqt, and Pryme received €15M, €15M, €15M, and €13M respectively.

Anticipated Major Financing Rounds in 2023

Although the first half of 2023 did not witness any major financing rounds exceeding €60M, the report suggests that the upcoming months will be crucial. Many startups and scale-ups that secured funding during the peak of the market in 2021 are expected to initiate new and potentially larger funding rounds later this year. These rounds will support international expansion, production capacity, and capturing a larger market share.

The Resilience of the Dutch Startup Sector

Lucien Burm, chairman of the Dutch Startup Association, highlights that the Dutch startup sector remains resilient despite challenging economic conditions. While investors seem cautious and adopt a wait-and-see attitude, the second half of the year will likely reveal whether the market has recovered and passed the turning point. The report also notes that the Netherlands outperforms neighboring countries where investments continue to decline.

The Dutch startup scene experienced significant growth in Q2 2023, with €525M raised in venture capital. Biotech, fintech, and cleantech sectors emerged as key players, attracting substantial investments. The report emphasizes the importance of fostering favorable conditions for startups, maintaining innovation, and providing necessary support to sustain the Dutch ecosystem’s growth. With anticipated major financing rounds on the horizon, the future looks promising for the Dutch startup sector, which has the potential to make a significant impact on the economy and society.