The fintech industry is rapidly evolving and disrupting traditional financial systems. In this article, we bring you the latest research insights to help you stay ahead of the curve and understand the future of financial technology. Enjoy researching!

Customer data access and fintech entry: early evidence from open banking (World Bank)

This staff working paper, authored by Tania Babina and others, focuses on open banking (OB) and its impact on consumers, fintechs, and small-medium enterprises. It reveals that OB policies are adopted in 49 countries, with consumer trust in fintechs playing a crucial role in policy adoption. The paper presents UK microdata demonstrating that OB facilitates consumer access to financial advice and credit, and enables SMEs to establish new fintech lending relationships. The calibrated model suggests that OB universally improves welfare through entry and product improvements for advice but may lead to higher prices for credit, particularly for certain consumer segments. Comments and debate on these findings are always welcome and appreciated! Read more

F-Prime releases the 2024 State of Fintech Report (Fintech Nexus)

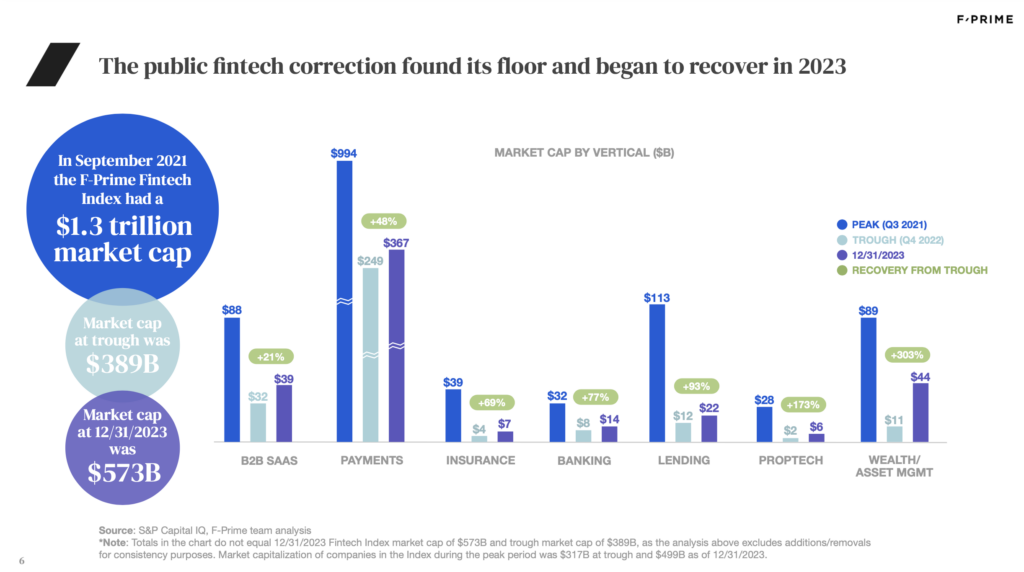

The F-Prime 2024 State of Fintech report reveals a correction in public fintech valuations from the Q3 2021 peak, with a recovery from the Q4 2022 trough. Private markets show decreased valuations and funding rounds, except for seed funding. Fintech companies can anticipate series B funding challenges, leading to predictions of increased M&A activity and shutdowns in 2024. Incidentally, M&A declined by 72% in 2023, which can indicate a slower market for acquisitions. Fintech disruption is noted in mobile and business banking, while trends for 2024 include payments tooling, vertical APIs, wealth tech digitization, AI for professional services, emerging markets fintech, and stablecoins. The F-Prime Fintech Index rebounded in 2023 but is still below its late 2021 peak. While there hasn’t been a major fintech IPO in the last two years, the report suggests a potential increase in IPOs in the near future. Read more

Large listed companies on the right track with transparency about 2030 climate goals in annual report, road to 2050 still unclear (AFM)

The AFM (Authority for the Financial Markets) has released a report highlighting a lack of transparency among large listed companies regarding their strategies for achieving net-zero carbon emissions by 2050. While these companies are clear about their climate objectives until 2030, the path to climate neutrality after 2030 is often vague, with various technological and financial challenges and risks not clearly addressed. The report emphasizes the importance of transparency in reporting sustainability information, especially with the implementation of the Corporate Sustainability Reporting Directive (CSRD) from January 1, 2024. The AFM expects companies to provide clear explanations about uncertainties and challenges they face in achieving net-zero targets, including technological, financial, and climate-related risks. The report also encourages transparency in the use of carbon capture and storage, offset projects, and carbon credits, urging companies to critically assess the quality of voluntary carbon credits and offset projects. Additionally, the AFM emphasizes the importance of data quality in sustainability reporting and calls for transparent explanations regarding the maturity levels of data quality in companies. The report provides recommendations, examples, and a self-assessment to support companies in achieving transparent net-zero objectives. This report is prsented in Dutch. Read more

Consumer vulnerability in the digital age (OECD)

The OECD Digital Economy Papers series includes a report titled “Consumer Vulnerability in the Digital Age” from the Directorate for Science, Technology, and Innovation. This report addresses the nature and scale of consumer vulnerability in the digital era, considering emerging digital trends and their implications for consumer policy. The key finding is that, in the digital age, vulnerability is not limited to specific groups but is increasingly experienced by most consumers. The report suggests measures to address vulnerability for specific groups and all consumers, emphasizing the need for further research in this area. It serves as a valuable resource for policymakers and researchers in the field of consumer policy. Read more

Organizational health is (still) the key to long-term performance (McKinsey & Company)

McKinsey’s research underscores the pivotal role of organizational health in predicting sustained value creation and competitive advantage. Healthy organizations consistently outperform unhealthy ones, delivering three times the total shareholder returns over the long term. Key trends include a leadership transformation emphasizing decisive leadership, the importance of data-driven innovation, and the power of dynamic talent deployment. The study highlights that health interventions contribute to positive outcomes in various scenarios, such as M&A, transformations, and periods of economic uncertainty like the COVID-19 pandemic. McKinsey emphasizes the need for leaders to prioritize organizational health in daily actions and decision-making, as it remains a foundational element for success and differentiation in the marketplace. Read more

-

Do you have any news to share? Please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion