The fintech industry is rapidly evolving and disrupting traditional financial systems. In this article, we bring you the latest research insights to help you stay ahead of the curve and understand the future of financial technology. Enjoy researching!

ECB Annual Accounts 2023 (European Central Bank)

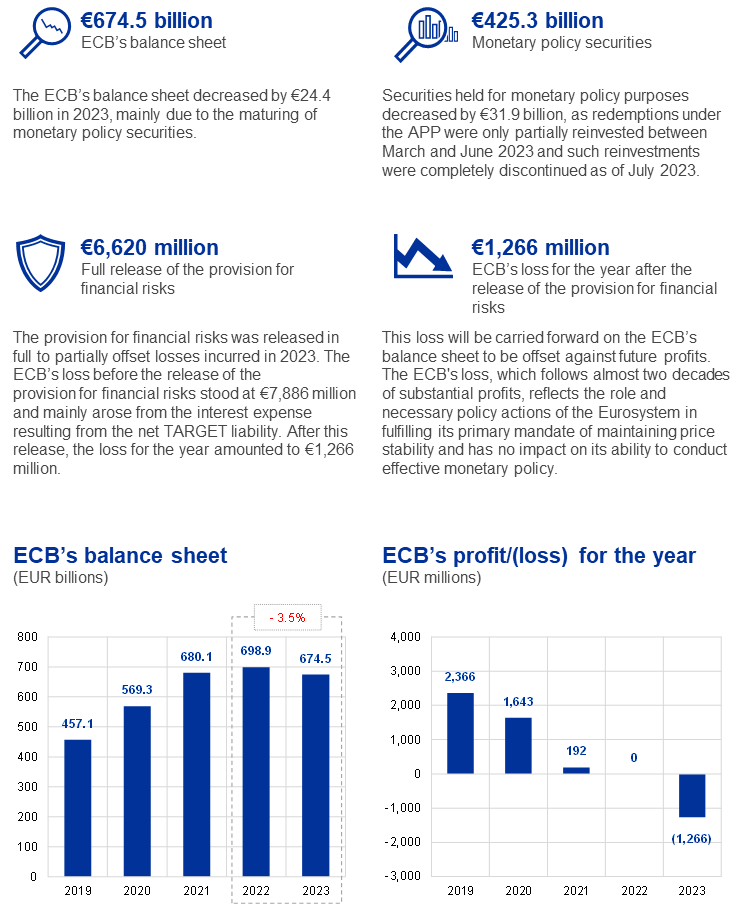

The management report is an essential component of the ECB’s Annual Accounts, providing contextual information on financial statements. It emphasizes the connection between the ECB’s policy objectives and its financial position, presenting an analysis of main tasks, activities, and their impact on financial statements. The report covers developments in the balance sheet and profit/loss account, includes information on net equity, and describes the risk environment, outlining specific risks and risk management policies. Overall, it offers a comprehensive overview of the ECB’s operations, financial performance, and risk management. Read more

Country Report: Indonesia – Asia’s next growth story (Payments Cards and Mobile)

Indonesia’s dynamic economy, with the largest Asian population outside China, is attracting international interest. Over the past 30 years, the country has quietly modernized, and key trends include a rapid shift from cash to digital payments, notably digital wallets and QR codes. The government’s introduction of the Quick Response Code Indonesia Standard (QRIS) in 2019 and collaborations between banks and financial firms have accelerated the adoption of digital commerce. Indonesia’s digital wallet adoption has surged, making it the third-highest adopter in Asia after China and India. Expectations are that digital wallets will constitute nearly a third (28%) of all transactions by Q1 2024. Read more

The FinTech Journey Continues: What to Watch for in 2024 (FT Partners)

The FinTech sector in 2023 underwent a period of re-balancing, with fluctuations such as bank crashes and record highs in the S&P 500. This led to a reassessment of valuations and intermittent large deals as industry players re-evaluated business models. Despite these challenges, the sector exhibited resilience with steady early-stage funding and successes from established players. The FT Partners report discusses key themes expected to impact the FinTech landscape in 2024, covering areas like generative AI, real-time payments, and the growing influence of FinTech in emerging markets. Topics include a retrospective analysis of 2023’s FinTech M&A, financing, and IPO activities, key trends for 2024, and an exclusive interview with Jon Lear, President and Co-founder of Fintech Meetup, offering insights into the state of the FinTech market. Overall, the FinTech sector remains dynamic, with continuous innovation and reinvention shaping the future of financial services. Read more

Analyzing the progress of FINTECH-companies and their integration with new technologies for innovation and entrepreneurship (Medium)

The research aims to provide an overview of the progress made by Financial Technology (FINTECH) companies in integrating cutting-edge technologies like artificial intelligence, machine learning, and blockchain for innovation and entrepreneurship. Utilizing the Scopus database, the study focused on publications in English between 2014 and 2022. The analysis involved 302 pieces of research, employing qualitative data analysis techniques to identify prolific journals, countries, and authors. The study sheds light on trends, offering insights into contemporary problems and paving the way for new research avenues. Researchers have significantly contributed to understanding the development and current state of FINTECH companies through this comprehensive overview. Read more

Financial Technology (FinTech) Market Research Report Analysis Latest Trends and Prospects Demand Till 2024-2032 (LinkedIn)

The Financial Technology (FinTech) Market Analysis Report for 2024 explores the industry’s size, trends, and applications, covering P2P lending, crowdfunding, and others. The report anticipates unexpected growth with a significant CAGR from 2024 to 2032. It incorporates analyses, pre- and post-COVID-19 impacts, and considers the Russia-Ukraine war. The comprehensive report includes key players, such as Lending Club and Prosper, and provides a thorough overview of the market’s current and future objectives, offering insights for decision-making. It covers various types of FinTech and their applications, emphasizing versatility. Overall, the report serves as an effective tool for understanding the competitive FinTech landscape and market dynamics. Read more

ClearScore Calls For Change as UK Lending Market Contracts for Higher-Risk Customers (The Fintech Times)

The UK lending market for higher-risk individuals has contracted by approximately 34% since 2019, according to a whitepaper from ClearScore. Individuals with the lowest credit scores (‘sub-prime’) saw a steeper decline of 76% in the number of loans offered since 2019. This contraction is attributed to the removal of guarantor loans and high-cost short-term credit products from the market due to a combination of regulation and commercial considerations. The availability of unregulated lending, including buy now, pay later (BNPL), has risen in this context. The ClearScore whitepaper recommends regulatory and government actions to support and broaden access to the regulated market, including setting a clear strategy for a well-functioning non-prime lending market and reviewing how the cost of credit is communicated to customers. Read more

-

Do you have any news to share? Please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion