The fintech industry is rapidly evolving and disrupting traditional financial systems. In this article, we bring you the latest research insights to help you stay ahead of the curve and understand the future of financial technology. Enjoy researching!

Commercial banking top trends for 2024 (Accenture)

Commercial banks are navigating the delicate balance between addressing current challenges with caution and embracing technological innovation for future growth. With a growing emphasis on compliance and risk management due to regulatory pressures, banks are also investing in generative AI (gen AI) to foster innovation, enhance data capabilities, and automate various processes. Six key trends in commercial banking for 2024 include a shift from tactical cost reduction to strategic cost transformation, increased focus on new regulations impacting capital allocation, emphasis on deposit growth, a wake-up call in commercial payments, advancements in automated, data-powered lending, and the integration of generative AI in commercial banking. The report suggests that finding the equilibrium between present challenges and future opportunities will be crucial for banks to thrive in the evolving landscape. Read more

The rising complexity of board directorship (McKinsey & Company)

McKinsey’s “Inside the Strategy Room” podcast discusses the evolving role of corporate board directors, emphasizing the increasing complexity of their responsibilities in addressing challenges related to geopolitics, generative AI, digitization, sustainability, and other emerging topics. The conversation includes insights from experienced board members, highlighting the growing expectations for engagement on various strategic aspects such as investments, M&A, risk management, and talent development. The podcast also explores the concept of a “catalyst board” and the need for boards to act as catalysts for rapid change in response to industry shifts. The discussion underscores the importance of effective collaboration between boards and senior management, evolving engagement formats, and the role of boards in talent development and shaping organizational culture. Read more

Navigating the complexities of EMIR REFIT reporting: A cost-benefit analysis (Fintech Global)

MAP FinTech, a RegTech provider, analyzes the impact of the European Market Infrastructure Regulation (EMIR) and its amendments, known as EMIR REFIT, on reporting requirements. The comprehensive overhaul introduces complexities that may prompt firms to consider in-house reporting. However, MAP FinTech advocates for outsourcing EMIR REFIT reporting due to potential cost savings, expertise access, and enhanced compliance capabilities. The analysis highlights the financial and logistical challenges associated with in-house reporting and emphasizes the benefits of engaging external service providers, such as MAP FinTech, to navigate the regulatory landscape effectively. Read more

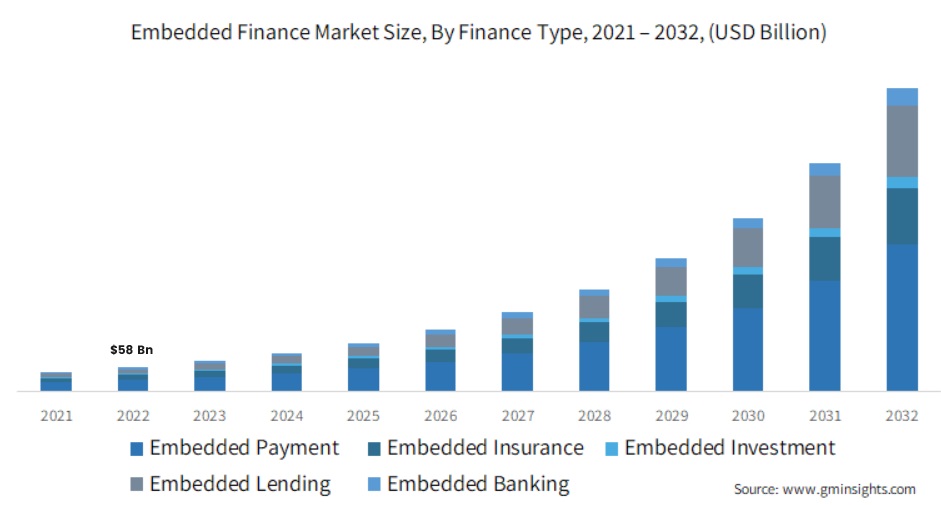

Embedded finance market to reach $730.5 billion by 2032 (Payments Cards and Mobile)

The embedded finance market, valued at $58 billion in 2022, is anticipated to exhibit a Compound Annual Growth Rate (CAGR) of over 29% from 2023 to 2032, reaching a valuation of over $730.5 billion by 2032. The growth is attributed to the surge in digital payments, driving the seamless integration of financial services into various platforms. Businesses are capitalizing on the trend by offering integrated financial products like digital wallets and lending services. The demand for frictionless customer experiences in payments, coupled with a focus on enhancing user experience, is fueling the expansion of the embedded finance market. The embedded lending segment is expected to secure a significant market share by 2032, reflecting the increasing demand for seamless and integrated lending solutions. Additionally, the logistics sector is set to achieve notable gains in the embedded finance industry through 2032, as logistics companies prioritize digital transformation and seamless financial integration for operations. The embedded payment segment, accounting for around $27.3 billion revenue in 2022, is driven by the growing demand for convenient and secure payment methods. Read more

Reimagining Peer-to-Peer Lending Sustainability: Unveiling Predictive Insights with Innovative Machine Learning Approaches for Loan Default Anticipation (MDPI)

This study explores the feasibility of developing prediction models for Peer-to-Peer (P2P) loan defaults without relying heavily on personal data. The goal is to create a computational model that aids lenders in determining the approval or rejection of a loan application, focusing on financial data provided by applicants. The dataset used contains 8578 transaction records with 14 attributes related to financial information, excluding personal data. The study employs various machine learning classification algorithms, including Random Forest, Support Vector Machine, Decision Tree, Logistic Regression, Naïve Bayes, and XGBoost. The findings indicate that borrowers failing to comply with credit policies, paying elevated interest rates, and having low FICO ratings are at a higher likelihood of defaulting. Clients obtaining loans for small businesses also pose an elevated risk. All classification models achieved satisfactory performance with an accuracy of over 80%. Logistic regression, with a decision threshold set to 0.4, performed the best for predicting loan defaulters, accurately identifying 83% of defaulted loans with a recall of 83%, precision of 21%, and an f1 score of 33%. Read more

-

Do you have any news to share? Please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion