Welcome to the Frictionless Finance Report, our monthly look at everything new in the world of Open Banking, FinTech, and consumer experience. This month we examine the proliferation in Open Banking usage, the positive future for the FinTech sector and the progress of Open APIs in North America.

Open Banking

We have articulated in some detail how there has been a proliferation in Open Banking, products derived from bank data, and increasing use case for digital technology over the last seven months. While to date, some of that could have been ascribed to hearsay, within the last week, we have had confirmation from the Open Banking Implementation Entity (OBIE).

The OBIE has illustrated that over the summer, the volume of active users using Open Banking has in fact, doubled, from 1m users in March, to 2m, now. The OBIE has calculated that around 45% of new users are in the 25 to 34 age bracket, suggesting that the use of mobile banking and Open Banking will be driven by young people. The figures provided also only include those from the CMA9, and not other major players such as Monzo and Starling, which would add to the figure considerably.

Imran Gulamhuseinwala, Trustee of the OBIE, said:

We can now see that people want to exercise their rights over their data and will do so, as long as you make it simple and secure. Open banking enabled products are rebalancing the market in favour of consumers and small businesses. Users are now able to engage more with their finances and getting access to better products.

David Beardmore, ecosystem development director, OBIE, followed:

Open banking will revolutionise the way we pay. While open banking payments are currently a small proportion of open banking usage, recent strong growth is a sure sign that people welcome more payments choice. We predict that payments will eventually form a considerable proportion of our growing user numbers.

There is considerable pickup of this news, including in P2P Finance News, AltFi, Finextra, Credit Strategy, Global Government Forum and Business Insider.

Gulamhuseinwala Interview

In the immediate aftermath of the good news from the OBIE, Trustee, Imran Gulamhuseinwala has given a number of interviews on the solid progress made by Open Banking over the last two and a half years. Gulamhuseinwala spoke on the definite progress made within Open Banking, reflecting that work was about “90% done” and that payments and refunds were the next thing on the agenda to be addressed.

The success of Open Banking, he says, can be illustrated by the fact that while the OBIE only had the power to force the CMA9 to implement it, 90% of the rest of UK banks have begun either using open APIs or have projects in development.

He says:

When I made the 90 per cent comments, which I stand by, there were two aspects that needed sorting out. One is some additional functionality in payments; the other is better performance of the APIs.

It was though, on the subject of Open Finance that Gulamhuseinwala became most excited. The ability of connecting other financial products, such as mortgages, pensions and credit cards will make a fundamental difference to the public’s relationship with money.

Gulamhuseinwala offers:

There is a lot of consultation going on at the moment in the UK about what open finance will look like but the scope could include pensions, mortgages, savings and insurance. That’s when it really takes off: all the data in one place built around serving the consumer.

He also spoke on the need for Premium APIs, saying that ultimately “they will further Open banking’s cause”.

News via AltFi, Global Government FinTech, Lend Academy and the Banker.

Open Future World Directory

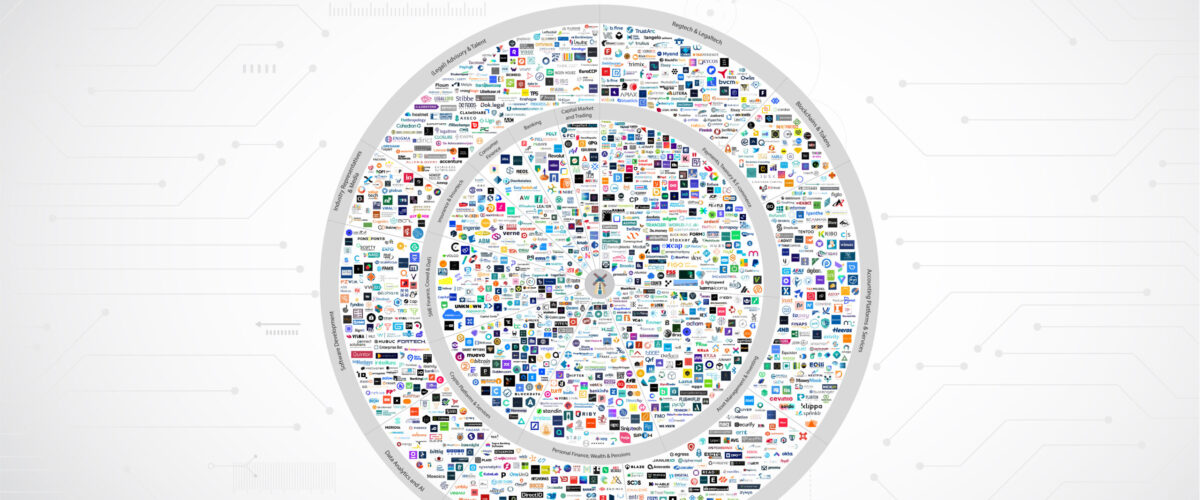

DirectID were delighted to be amongst the first signatories on a new directory, the first of its kind, outlining all the major players in the world of Open Banking & Open Finance. The directory is being spearheaded by Open Future World, the hub for global Open Banking and Open Finance.

Open Future World fellow co-founder Nick Cabrera, explained:

We want to encourage everyone in the sector to share their information and to make use of this free resource. As the directory evolves, we’ll be able to map the ecosystem, add more advanced search functionality and highlight some of the great case studies that are emerging.

James Varga, CEO of DirectID, added:

When I heard about the new directory, I was very keen to be involved, and we’re delighted to be on the list for the launch. Open banking has come a fantastic distance in the last two years and this will be of huge benefit to anyone seeking to understand the players in the open banking and open finance world.

The directory can be found at: https://directory.openfuture.world/

News via FinTech Times, the Paypers, P2P Finance News and LinkedIn.

Nesta Open Up Winners

Nesta have announced their cohort of Open Banking winners. Run in conjunction with the OBIE, the ‘Open Up’ challenge sought to find companies that were working on Open Banking solutions to better help consumers manage their money.

Mojo Mortgages, Plum, Moneybox and Wagestream were all announced as winners of the shared £1.5m prize pot.

According to FS Tech:

“The announcement comes as new research from Open Up 2020 found that over half (55 per cent) of people are currently trying to prepare their finances for another lockdown and 38 per cent want personalised guidance and support to help them manage their money better.

The winners were selected from a pool of 107 applicants, which resulted in 15 finalists. All have received both financial and non-financial support and since the start of the challenge their collective users in the UK have more than doubled. This growth is reinforced by recent data from OBIE, which revealed that users of Open Banking-enabled products now exceed two million.”

Further coverage can be found in ThisisMoney.

BEST OF THE REST IN OPEN BANKING:

- A new survey from ING suggests consumers remain suspicious of Open Banking products

- Simon Cureton of Funding Options has written on how Open Banking and consumer focused FinTech solutions can help the UK economy through the Covid crisis.

- A joint report from PensionBee and Plaid has asked regulators to focus on Open Finance before Open Pensions.

Open Banking Abroad

This month we explore new developments in Singapore, the US and Canada. It may be that the Covid pandemic has forced the hand of some North American financial institutions to explore digitalisation further – a trend that we have already earmarked in the UK and Europe.

AMERICA

The United States has seen considerable progress over the last six months despite the Federal authorities not becoming involved in Open Banking. In Finledger, they explore how the pandemic has forced consumers to bank digitally, where before they may have done it in person. Many banks however, and particularly their mobile offerings were not up to the standard required. this has led to many banks moving digitalisation further up their list of priorities in order that consumers receive a frictionless experience.

The Financial Brand has taken a contrary stance, arguing that with over 12m consumers using open APIs in the United States, that they are in fact, far ahead of Europe. While there been little mandated in the US, consumer pressures allied with market forces have led to the development of APIs. Standards provided by the Financial Data Exchange (of which DirectID is a member), have however worked in the place of any regulator.

CANADA

Speaking at a virtual roundtable, Eyal Sivan has called on the Canadian Government to speed up the implementation of Open Banking in the country. He argues that the boon for Canadian banks and consumers could be huge if they are quick to capitalise on the opportunity. He further laments the continued use of screen-scraping.

SINGAPORE

Open Banking in Singapore, with a total addressable market of upwards of $220 billion, could be a bigger shock to the Singaporean financial sector than digital banking. With new digital banks coming to market, and incumbent banks having been through extensive periods of digitalisation, all will have to focus on the needs of their customers in the new world of Open Banking.

Under the Monetary Authority of Singapore (MAS), which has been leading on Open Banking, the Singapore API Exchange (APIX) has currently 54 financial institutions alongside 351 FinTech companies.

Finance

As we’ve seen from the enhanced role being played by solutions such as bank data and Open Banking, it is clear that the global pandemic has focused minds on refreshing priorities. A number of articles this month have focused on how financial institutions are now looking at refreshing their tech commitments in line with consumer need.

A new survey from Lloyds Bank suggests that 88% of banking executives are now looking at investing in their technology resources. Almost two-thirds (62%) will increase investment in technology, while another third (32%) plan to enhance their relationships with FinTech’s to bring new services to market.

Adrian Walkling, head of financial services at Lloyds Bank Commercial Banking, commented:

Technology is crucial to improving long-term productivity in the sector, competitiveness and creating high-value jobs. Our survey suggests business leaders are firmly committed to developing the role tech plays in maintaining the UK’s position as a leader in financial services.

This is supported by an article in International Investment, penned by Huawei, which states that now is the time for banks of all stripes to invest in new technology that will allow them to face the future.

What may happen should banks not take the time to invest has been laid bare by PwC who have written a new report predicting that the primacy of the bank may be over. They highlight that in 2019 non-banks have lent more money to consumers than banks. This then calls in question the primacy of the banking sector. As the sector morphs into a platform-based model, banks, write the authors, need to conclude how they will continue to add value to the end consumer.

What this technology looks like, has not been extrapolated on in the above texts. However, in The Next Web, the writer has taken the time to assess exactly what new technologies the financial industry should be looking at are. They conclude that Natural Language Processing (NLP), Customer Intelligence, Smart Crime Detection, APIs and blockchain and crypto will all prove to be key.

BEST OF THE REST IN FINANCE:

- We have our obligatory message regarding the death of cash, courtesy of FS Tech & PaymentSource

- FinTech Futures and Bobsguide have further fall out from the leaked FinCEN files

- Finextra examine whether big tech is really trying to take over the financial sector

- Are new payment services such as Account-to-Account (A2A) the future for payments? Sarah Kocianski in the Paypers discuses, while Ron Kalifa in the FT argues that while modernisation of payments is necessary, consumers must also be protected.

FinTech

With FinTech being one of the sectors that has benefited from the new way working methods and the drive for digitalisation, there has been much conversation around ‘what comes next’?

This month, there been a wealth of reading on the predictions for the future of the industry, and who the likely winners and loser might be.

Tribe Payments, have launched a new report, and been reported in Finextra and FS Tech, examining what the sector will look like in 2030. They conclude that FinTech will have evolved to become “embedded technology” that is tech that we use in our everyday lives, and outwith of financial services. They interviewed 125 executives to reach their conclusion, and have given examples such as payments becoming automated or “invisible”.

Importantly, they also concluded that the success of FinTech would not lead to the downfall of the current incumbent banks, with most predicting a partnership model.

A panel of FinTech experts also came together for the Scotsman newspaper to discuss the tech scene locally. They also concluded that the agile way of working for tech firms, allied with their huge tech know-how has allowed them to pivot and stay ahead of the challenges that have been presented through the Covid pandemic.

Oli Henderson of consultancy firm EY, said:

Those supporting the shift to a virtual financial world have seen an increase in interest and activity. Open banking has been a big game-changer and fintechs supporting that, and supporting big financial services institutions, are very much in demand. There are lots of positives for fintech in the massive negative of Covid-19.

At the same time, others have begun to forecast what the long-term future is, including whether FinTech firms will survive, or whether they may begun to be bought over.

Sifted have compiled a list of companies that could begin considering an IPO in the near future. The list contains some of the largest European FinTech’s, and throws in brewer Brewdog for good measure.

And for those that are not doing as well, FS Tech say 90% of FinTech leaders expect a rise in the volume of M&A activity for those firms that begin to run out of cash. A lack of seed funding is cited as being the main reason for cashflow issues.

What then, are investors looking for when they invest in FinTech firms? AltFi has been looking at this very issue and concluded that first and foremost, they are looking at firms that are more mature, citing evidence that some of the biggest European startups gained the lion share of investment capital. Other important factors include a strong path towards profitability, a strong differentiator from the competition and a strong leadership team.

Read the original report here.