For this research overview, we explore the first edition of the Emerging Payments Association’s Guide to Payment Account Providers, regard the pros and cons for facial recognition technology, get an accurate image on the current Dutch economy, see where the UK payments sector is heading towards, dive into the most recent tech trends, and tackle the obstacles for SPAC mergers. Happy reading!

On Payments…

EPA Guide to Payment Account Providers (Emerging Payments Association)

This first edition of the Emerging Payments Association’s Guide to Payment Account Providers gathers data from UK providers to contribute to an independent, objective summary of providers. With the payments industry opening up significantly over the last 3-4 years, much criticism has been addressed from the past actions, such as lack of inclusivity or providers in certain payment schemes or accounts. This report shows a progression of the industry and the aim of introducing other providers in due course. Read more

On Facial Recognition Technology…

Transparency and Accountability Mechanisms for Facial Recognition (GMF)

In a recent policy brief by GMF, strategies for addressing challenges associated with facial recognition are highlighted. The recommendations within the report provide policymakers with concrete options for setting guardrails and aim to stimulate debate on possible paths forward. The findings explore three existing regulatory mechanisms of general application that may have specific relevance to facial-recognition technology: data protection impact assessments, technical standards, and certification mechanisms. Read more

Recap on the current Dutch Economy…

The State of Dutch Tech (Techleap.nl)

Constantijn van Oranje, Prince of the Netherlands, is highlighting in this analysis the importance startups have for the Dutch economy, the current state of the tech landscape in the Netherlands, and the potential future direction of the startup ecosystem. The findings illustrate what 2020 has brought to the Dutch tech, where the market stands at the moment in relation to other European ecosystems, and strategies to help maximize the opportunities of 2021. Read more

Where is the UK Payments heading towards in the next 10 years?

Future Ready Payments 2030 (UK Finance & PwC)

According to the finance of this report, the opportunities and challenges for the UK payments industry over the next ten years are considered, with a view on what the 2030 payments landscape will look like. The UK payments industry has long been regarded as being at the forefront of innovation and best practice and is expected to only develop, as new technological advancements and evolving customer expectations will drive change in the market. Read more

Tech not to be missed…

12 Tech Trends To Watch Closely In 2021 (CB Insights)

In this report, new trends for this year are explored in terms of latest technological advancements. From the mass adoption of telehealth to the remote workforce, technology has moved front and center as every industry grapples with the effects and fallout of the Covid-19 pandemic. Trends to watch out for include crypto breaks into the mainstream with rewards & loyalty programs, and physical spaces are reimagined and repurpose. Read more

Q&A SPAC mergers…

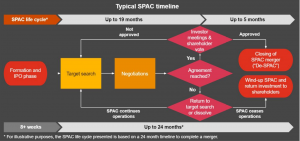

Domestic SPAC mergers - financial reporting and accounting considerations (PwC)

This paper highlights the obstacles that come with the merger of a SPAC with a target company. The findings highlight several of the financial reporting and accounting considerations and dive into common Q&A on the SPAC merger process, such as “Super 8-K” reporting, and the ongoing reporting requirements subsequent to the SPAC merger. Read more

—

Do you have any news to share: please put feed@https://hollandfintech.com/ on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here: https://hollandfintech.com/featured/newsletters/. In order to see our other weekly highlights, check out the following links: analysis & opinion, funding, news.