It’s debatable in what country buy now, pay later first began. While Affirm began offering longer term financing in the United States in 2012, “split pay” offerings really began taking off in Australia with services like Afterpay in 2014, Openpay in 2013, and Zip 2013, and in Europe with Klarna as far back as 2005.

Looking at market penetration, Australia and the UK are further along the adoption curve and have already seen some regulatory scrutiny of the category, which may provide clues about the product category’s future in other markets.

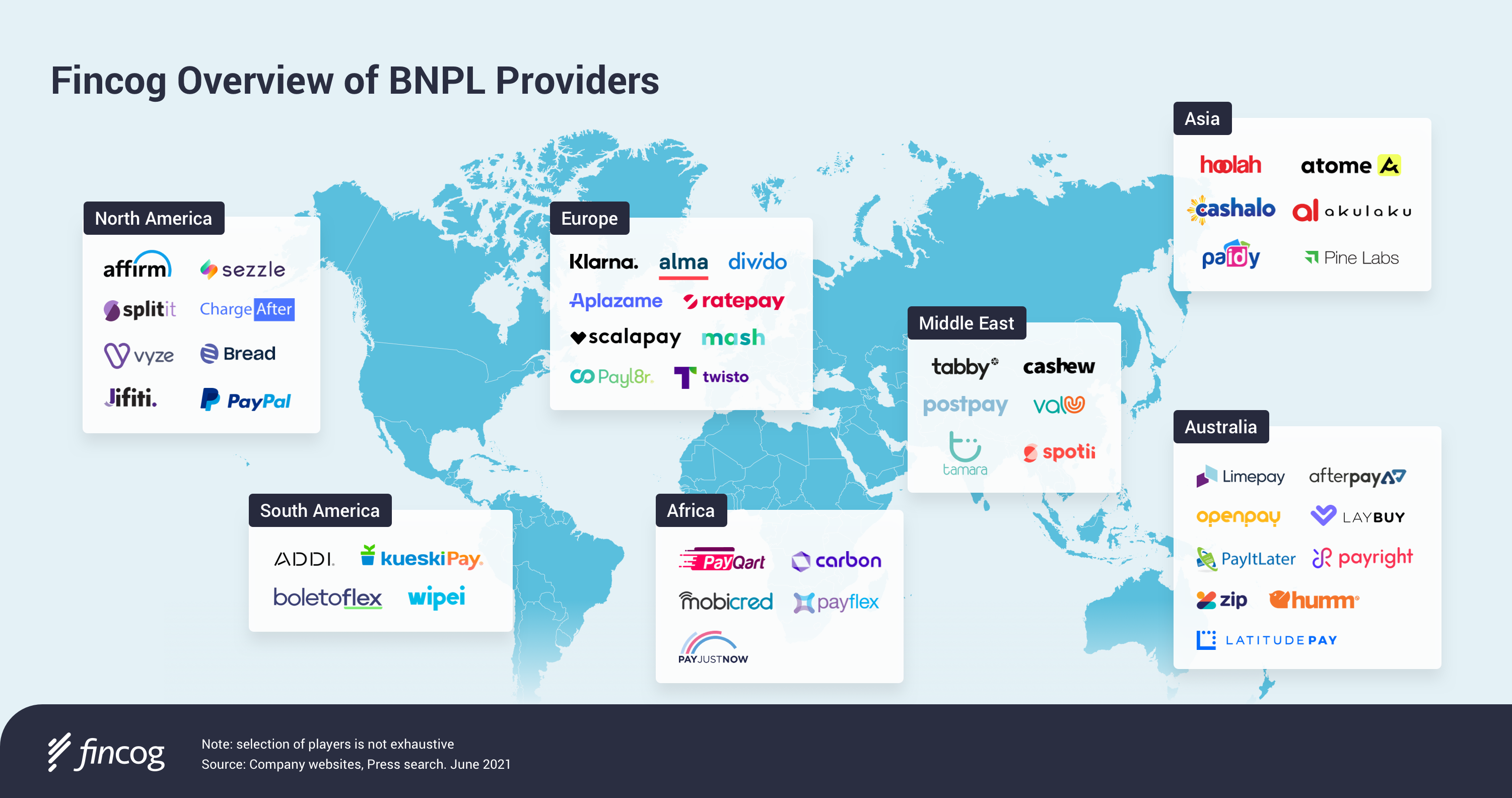

While players like Afterpay and Klarna have successfully expanded across multiple geographies, BNPL remains balkanized, with discrete market leaders emerging in different countries / regions.

An emerging BNPL player that may change this is Paypal. While currently Paypal only offers “split pay” (pay in 4) and longer term financing (Paypal Credit) in the US, UK and Germany, the longtime e-commerce veteran has made clear it recognizes the opportunity and is moving aggressively, leveraging its expansive base of existing merchants.

Read the original article here.