RIJSWIJK - After a successful pilot with Rabobank, Informer is the first to get access to the newly developed API connection. With this API, bank data can be directly loaded into Informer without the intervention of a third party. This link is a logical next step to the recent PSD2 legislation for open banking as it resolves a number of major drawbacks of PSD2.

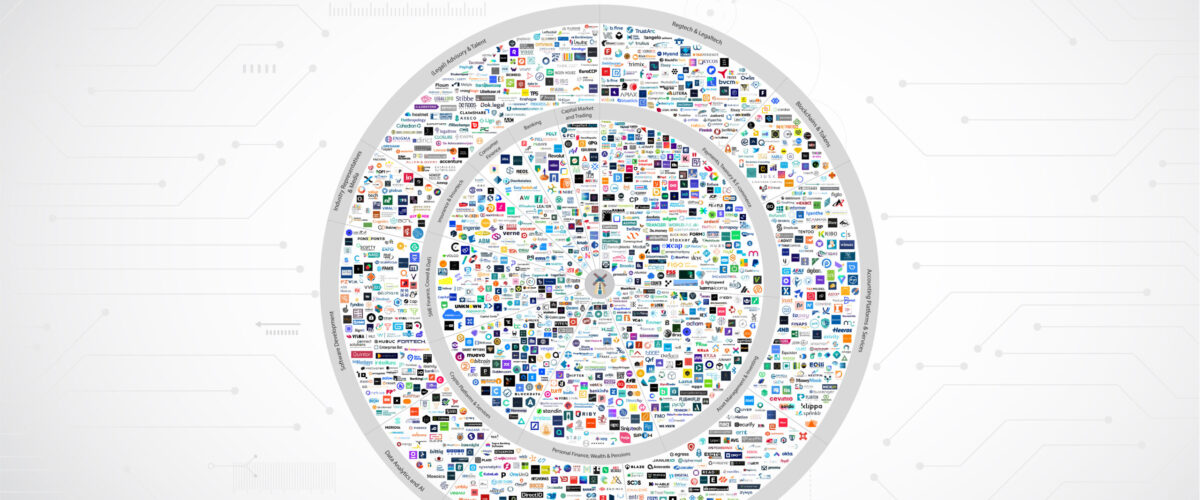

Open banking has experienced strong growth in recent years and continues to do so. Many companies offer financial solutions, making integrations and connections with real-time banking data essential for new solutions.

New API interface goes beyond PSD2

Rabobank has developed a new API that provides a faster and more accurate picture of the financial situation of a company. With this API, business owners only need to give Informer access to their financial data once. This is in contrast to the PSD2 legislation that requires customer approval every 90 days.

In addition, with this API, the account information of entrepreneurs can be requested much more frequently than with PSD2, where this is only requested four times a day. Finally, entrepreneurs now also have insight into their savings account through Informer, a frequently mentioned shortcoming of the PSD2 guidelines.

Informer leading the way in open banking

This new Rabo accounting connection is not the first innovation in which Informer is leading the way. For example, in 2016 Informer had a world first with the direct API with Bunq which facilitated the first real-time connection between an accounting programme and bank. Also in 2016, they launched ING’s new QR feature that makes it easier and faster to pay invoices using the ING app. Lastly, Informer was the first accounting program to have an API with the Dutch tax authorities allowing entrepreneurs to easily submit their VAT returns and pay via iDEAL.