The fintech industry is rapidly evolving and disrupting traditional financial systems. In this article, we bring you the latest research insights to help you stay ahead of the curve and understand the future of financial technology. Enjoy researching!

More digital, more productive? Evidence from European firms (ECB)

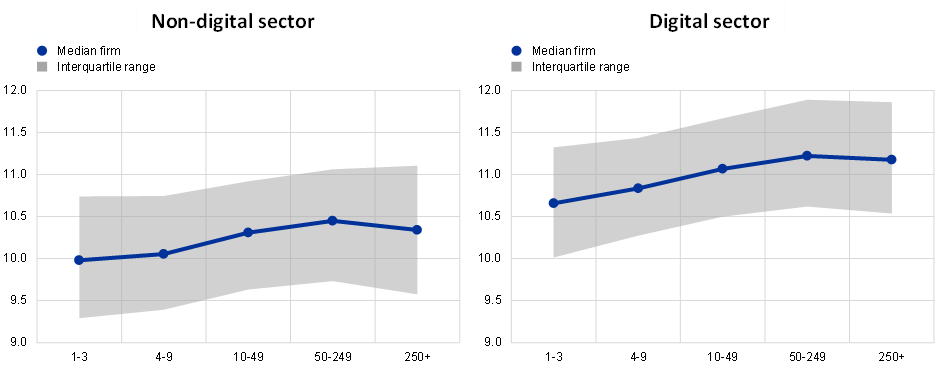

Digitalisation promised to be a productivity gamechanger, yet we are still facing a “productivity paradox” at the aggregate level. For decades, rapid advances in digitalisation have coincided with a protracted slowdown in aggregate productivity growth. But studies based on micro firm-level data have repeatedly found that digitalisation does improve the productivity of individual firms. Digitalisation might be like other general-purpose technologies in that it could take a while to deliver its potential productivity gains. If adopted successfully it could become a gamechanger, because of the faster and much more wide-ranging use of digital technologies during the COVID-19 pandemic. European policymakers have also made the issue a priority with policies like the EU’s Digital Single Market and Next Generation EU initiative. We took a closer look at the role of digitalisation in firm-level productivity growth over the past couple of decades. To do this we examined total factor productivity (TFP) at the firm level. TFP is basically the growth in output (production and services) that can’t be explained by the growth in input (labour and capital). It shows how much more productive the existing inputs are. We used data for firms operating in Europe between 2000 and 2019, including 19.3 million firm-level observations containing information from nearly 2.4 million firms. Read more

The State of Consumer Banking & Payments Report: H1 2023 (Morning Consult)

This year began with a major crisis in the banking industry that has already seen noteworthy shares of adults move money between or out of banks and could lead to more downstream changes to relationships if the situation worsens. While trust remains intact for now, consumers’ minds have turned toward switching providers. Meanwhile, Gen Zers continue to reshape the industry with their payment preferences. KEY TAKEAWAYS: Financial well-being remains lower than in 2021: Inflation and interest rate hikes have impacted the financial well-being of all households, regardless of income; Bank failures shine a light on trust: Consumers have faith in the industry even after the collapse of three regional banks; Digital wallet dominance continues: Bank branch and ATM visits are becoming a thing of the past.

Gen Z has arrived … in debt: The youngest generation is shaping consumer payment and credit trends. Read more

78% of European retail leaders are positive on growth prospects (Payments Cards & Mobile)

European retailers have not known such an extended period of uncertainty since the financial crisis of 2008–2009. And they have a difficult year ahead, marked by high costs and consumer demand constrained by inflation. While retailers have braced themselves for the slowdown, they are also preparing for an eventual recovery. The European Retailers Chart a Path to Profitable Growth report, provides a deep understanding of the challenges and investment priorities of senior retail executives. Less than half of European retailers say that their revenue growth outlook is positive in 2023, with high energy and financing costs cited as the toughest operational challenges that they will face over the next year. However they are more upbeat about 2024. In fact, 78% describe their sales outlook as positive next year. Read more

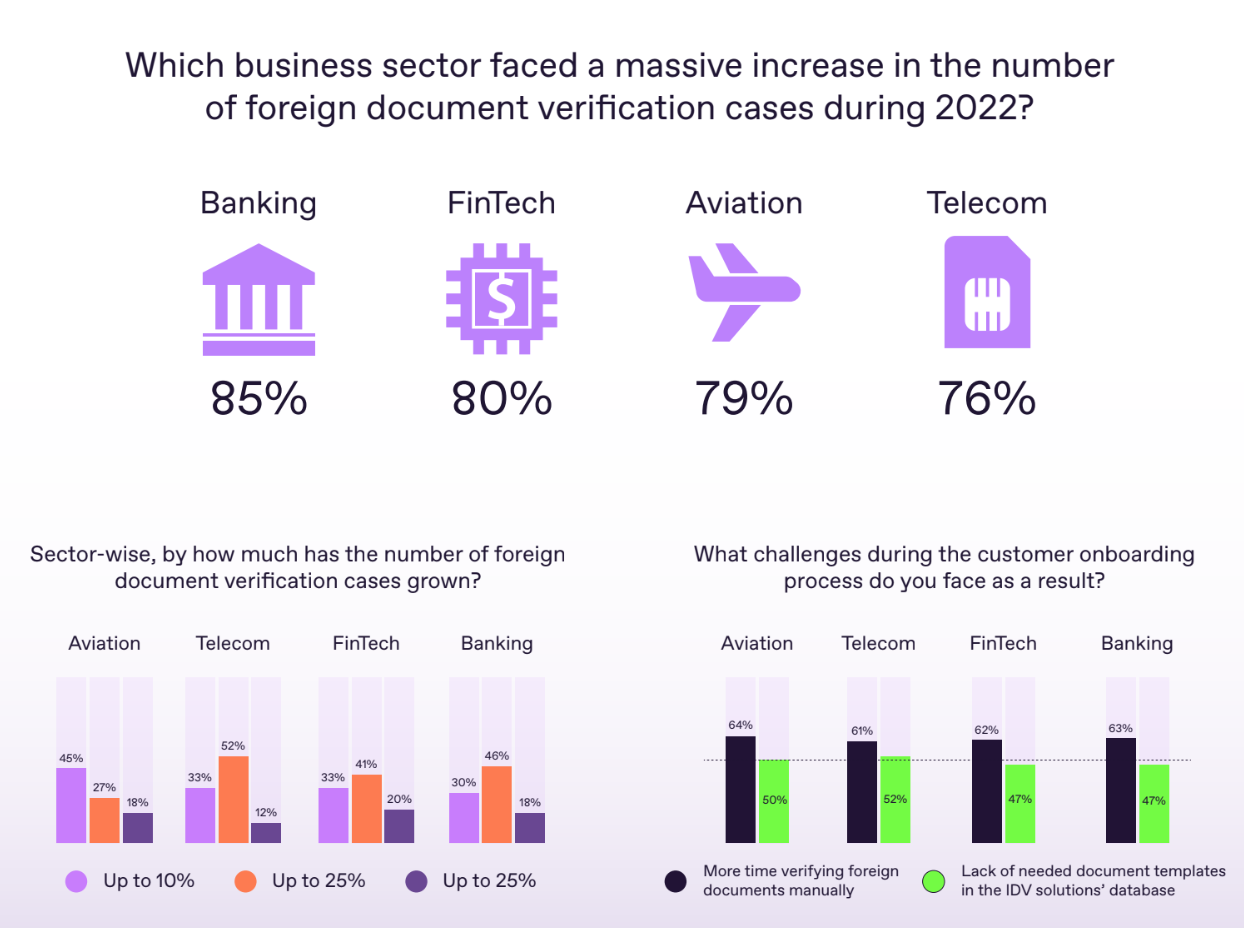

Rise of Digital Nomads Introduces Identify Verification Challenges to Banks and Fintech Companies (Regula)

The rise of remote work is forcing adjustments within businesses and introducing new challenges. For finance and technology businesses, the number of foreign document verification cases has increased considerably throughout the years, a development which organizations are struggling to deal with. A new research initiated by Regula, a provider of identity verification solutions and forensic devices, found that businesses in the banking and fintech sectors are ill-equipped to address these market changes with many still relying to manual checks when performing identity verification. The findings, shared in a report titled The State of Identity Verification in 2023, draws on primary research and a survey of 1,069 decision-makers in the banking, fintech, technology, telecoms, and aviation sectors, to understand how businesses around the world are working with identity authentication. Results show that the banking and fintech sectors have been particularly impacted by the rise of digital nomads, with 85% and 80% of respondents, respectively, witnessing an increase in the number of document verification cases involving foreign nationals during 2022. Read more

Report: Business Payments Barometer 2023 (Payments Cards & Mobile)

Bottomline, in their annual Business Payments Barometer report, reveals that finance leaders in Great Britain and the United States are facing a tough operating environment, with over 80% of businesses (82% in GB and 88% in the US) forced to accept new payment methods in the last 12 months. Financial decision-makers are also continuing to tackle a rise in fraudulent activity, as 39% of GB and 35% of US businesses experienced payments fraud over the last year. The findings stem from the eighth annual Business Payments Barometer research, which interviewed 1,600 financial decision makers in the US and GB, across a range of business sizes and industries. Read more

–

Do you have any news to share: please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion