This analysis article focuses on the opinions and insights from industry experts. On latest news, we explore the agreement reached between Facebook and the Australian government, the potential of remittances, look into SMB neobanks, explore whether inflation is making a come back, look at the key relationships between governments and AI creators, and check the countries countries where cryptocurrency use is most common. Happy reading!

The Real Story of What Happened With News on Facebook in Australia (About Facebook)

Nick Clegg, VP of Global Affairs at Facebook, explains the latest details on why Facebook reached the decision to stop the sharing of news on its service in Australia in opposition to the proposed news media bargaining code. This has now been resolved following discussions with the Australian Government, as Facebook reversed the ban. For the everyday user, this movement revealed that we don’t own the content we post on these platforms and can lose access to it at any time. Read more

Mobile money-enabled remittances are a lifeline for families of migrant workers (GSMA)

Nika Naghavi, Data & Insights Director at GSMA, and Lamia Naji, Senior Insights Manager at GSMA, dive into the implication of Covid-19 for the economy and also the severe consequences on migrant workers and their families in the developing world. With around 800 million people in the developing world dependent on remittances, this sector has been developing at a fast pace thanks to mobile technology. Mobile money platforms can make international remittances more cost-effective, efficient, and secure. Read more

The US Fintech Domino: Bank M&As and SMB Neobanks (WhiteSight)

In this analysis, an overview on neo-banking and digital challenger banking space is given. The findings suggest that neobanks who cater to small and mid-size businesses (SMBs) will emerge as significant players in the fintech ecosystem in the coming years. The results show how SMB neobanks operate in the US and the challenges and opportunities that they face in the wake of the recent banks’ M&As. Read more

Getting the Social Cost of Carbon Right (Project Syndicate)

Nicholas Stern, a former chief economist of the World Bank, and Joseph E. Stiglitz, a Nobel laureate in economics and University Professor at Columbia University, dive into a new initiative taken by US President Joe Biden’s administration against climate change. The group’s task is to devise a better estimate for the dollar cost to society (and the planet) of each ton of carbon dioxide or other greenhouse gases emitted into the atmosphere. The number, referred to as the social cost of carbon (SCC), gives policymakers and government agencies a basis for evaluating the benefits of public projects and regulations designed to curb CO2 emissions – or of any project or regulation that might indirectly affect emissions. Read more

Will Inflation Make a Comeback? (Project Syndicate)

Axel A. Weber, a former president of the Deutsche Bundesbank and former member of the Governing Council of the European Central Bank, explores economic forecasting models for inflation rates, and how Covid-19 has affected this relationship. According to current prediction analyses by many banks, central banks, and other institutions, it is suggested that inflation will not be a problem in the foreseeable future. Read more

We need to talk about Artificial Intelligence (World Economic Forum)

Adriana Bora, AI Policy Researcher and Project Manager at The Future Society, and David Alexandru Timis, Outgoing Curator, Brussels Hub, Keynote Speaker and Author on AI, Future of Work and Online Learning, explore the main challenge to AI technology implementation: lack of information exchange between creators and policymakers. This analysis looks at the AI integration within industry and society and its impact on human lives, which calls for ethical and legal frameworks that will ensure its effective governance, progressing AI social opportunities and mitigating its risks. Read more

Bitcoin will remain a diversification strategy as prices surge, says WEF blockchain chief (CNBC)

Sheila Warren, head of blockchain at the World Economic Forum, joins “Squawk Alley” to discuss the rush of new investors into bitcoin. The discussion revolves around the volatile nature of the cryptocurrency, and the energy implications to support the distributed ledger technology. More institutional investments are expected in 2021, with Bitcoin being part of a portfolio diversification strategy. Read more

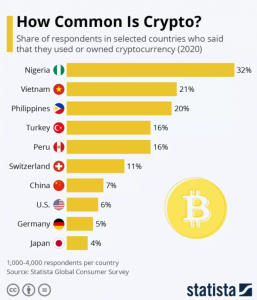

These are the countries where cryptocurrency use is most common (The World Economic Forum)

Katharina Buchholz, Data Journalist at Statista, explains why cryptocurrency use is on the rise, with 33% of Nigerians either using or owning cryptocurrency, according to a recent survey. Cryptocurrency has become popular as a cheaper solution to sending money across borders. For example, the Philippines’ Central Bank has approved several crypto exchanges to operate as “remittance and transfer companies” in the country. Read more

—

Do you have any news to share: please put feed@https://hollandfintech.com/ on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here: https://hollandfintech.com/featured/newsletters/. In order to see our other weekly highlights, check out the following links: research, funding, news.