There is a staggering amount of money laundered each day

Most financial institutions require a manual and recurring effort to achieve an up-to-date understanding of their clients. This majorly affects the quality of compliance efforts and as a result, money laundering detection.

As decisions are made in real-time, teams often have to make them on an incomplete picture, leaving institutions exposed to risk and limiting their ability to take advantage of opportunities.

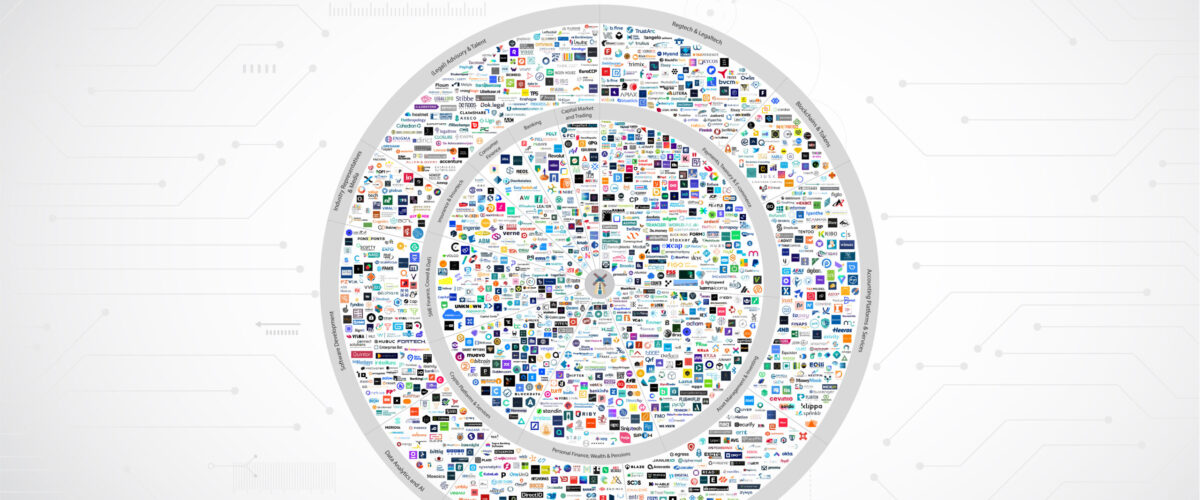

Both regulators and financial institutions turn to innovation to decrease the costs of AML compliance but there is more to it than billions in financial losses.

Download the white paper here.