In terms of research and stats, this week’s fintech news is marked by developments within digital bill payments, virtual card transactions, treasuries, cloud computing, APIs, banking, consumer payments Happy reading!

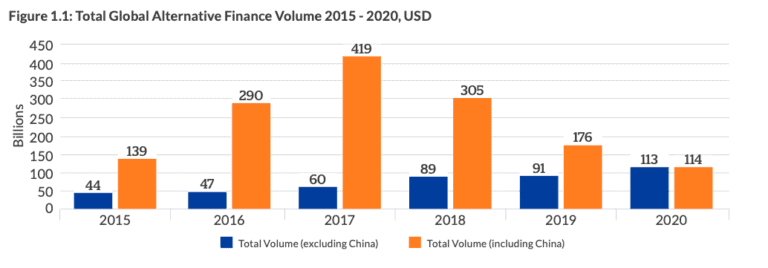

Cambridge Centre for Alternative Finance Report: Total Global Alternative Finance Volume Increases, If You Remove China (Crowdfund Insider)

This report provides data on the global alternative finance industry. According to the report, China, once the largest alternative finance market in the world, now barely registers having gone to nearly zero. This is due to a regulatory and policy shift away from this sector of Fintech. Read more

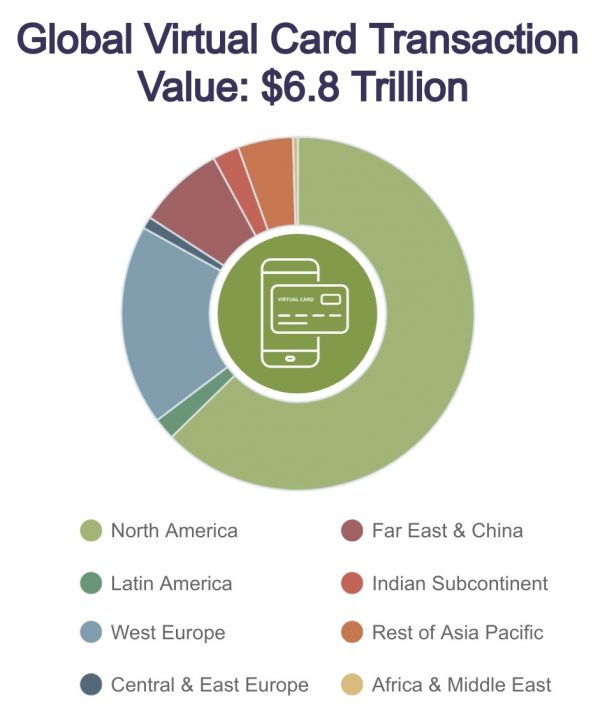

370% growth in use of virtual card transactions globally (Payments Cards & Mobile)

A new study by Juniper Research has found that the global value of virtual card transactions will reach $6.8 trillion in 2026, from $1.9 trillion in 2021. Virtual card transactions, secure digital cards with randomly generated details, will show strong growth as they are increasingly used for B2B payments. It is predicted that outside of the dynamic B2B market, the added security from virtual cards will also appeal to the consumer market. Read more

Overcoming Cloud Adoption Challenges (FS Tech)

This report dives into the current cloud adoption landscape and draws the best strategies for overcoming skills gaps and cultural barriers. While the concept of cloud transformation is nothing new, entrenched legacy systems and the complexity of migrating workloads have meant that successful adoption has been patchy at best in the past year, with many firms squeezed between the biggest, most well-resourced incumbents, and the smaller, flexible FinTech startups. Read more

Post-Covid-19 Checkpoint: What did Treasuries learn and how should they change for the future? (Planixs)

Researchers surveyed treasury professionals from banking organisations all over the world, asking them a series of questions to establish what they found most challenging during the pandemic, and now, as we emerge from this phase of the pandemic, what their key takeaways were from managing their treasury operations during lockdown and also how their experiences will inform their plans to be better prepared for the future. Read more

Digital bill payments gain steam even as pandemic conditions improve (Insider Intelligence)

This study shows that more than one-quarter (26.7%) of US consumers reported using mobile wallets to pay bills more frequently during the pandemic, which bodes well for their ability to rack up bill pay volume as the industry digitizes. Many US consumers said the convenience of using various wallets to pay bills is “important” or “very important,” with PayPal (43%), Apple Pay and Google Pay (32%), and Venmo (27%) leading the pack. Read more

Annual APIs and Integration Report – 2021 (Fintech Futures)

This paper looks at APIs, integration and microservices to give a better understanding of how these technologies are being adopted. Software AG worked with Vanson Bourne to survey 950 IT executives, including more than 150 in financial services to provide insights for this innovation. Read more

Analyst report: Expectation versus reality for payments data monetisation (Fintech Futures)

Findings show that investment in payments data monetisation is growing with 38% of banks reporting that supporting payments data monetisation initiatives is a clear objective of their payment infrastructure investments. Corporates are willing to pay for many value-adding services with 79% of banks believing that demand among corporate clients for data-led services is increasing. Read more

—

Do you have any news to share: please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here: https://hollandfintech.com/featured/newsletters/. In order to see our other weekly highlights, check out the following links: analysis & opinion.