For this week’s research article, we dive into new insights on insurtech, mortgage, business activity, payments, neobanks, funding and SMEs. Happy reading!

Future 50 Europe: THE 50 RISING INSURTECHS REVEALED (Insurtech Insights)

Insurtech Insights and their partner Sønr are excited to reveal the Future50 Europe ranking. A carefully curated list of the 50 most innovative early stage insurtechs that are disrupting the insurance industry in Europe. Read more.

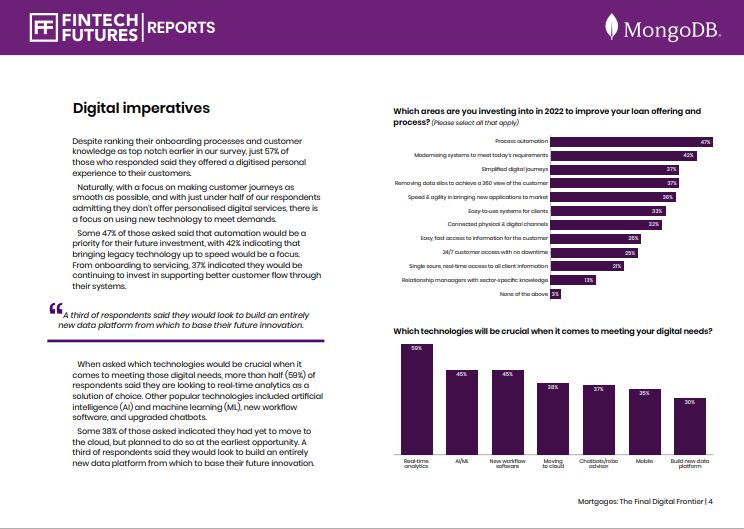

Mortgages – the final digital frontier (Fintech Futures)

Alex Hamilton, analyst at Fintech Futures, analyzes the fact that there are few financial products as personal as a mortgage, so providers always feel they must provide a perfectly personalised service. Whether in the form of stacks of paper or an organised database, data is not only a key part of day-to-day origination and processing, but also a fundamental building block for the initial and ongoing relationship between loan originator and customer. Read more.

B2B Domestic Payments Forecast To Exceed $54 Trillion by 2023 (Fintech Times)

Tyler Smith, analyst at Fintech Times, highlights a new data from Juniper Research, which predicts a growth of 10%; reflecting a slow recovery in business activity following the impact of the Covid-19 pandemic. According to it, the transaction value of B2B domestic payments across payment methods is forecast to exceed $54 trillion in 2023; up from $49 trillion in 2021. Read more.

84% Of SMEs Suffer From the Late Payments Domino Effect, Affecting Growth and Employees’ Payments (Fintech Times)

Writers at Fintech Times analyze tomato pay’s research, which has discovered that 84% of small businesses suffer from late payments. Late payments are threatening the survival of small businesses across the UK, according to findings from new QR-code payment and invoicing app. One in eight (12%) wait more than 60 days on average for an invoice to be paid, while one in 50 (2%) have to wait more than 90 days. Read more.

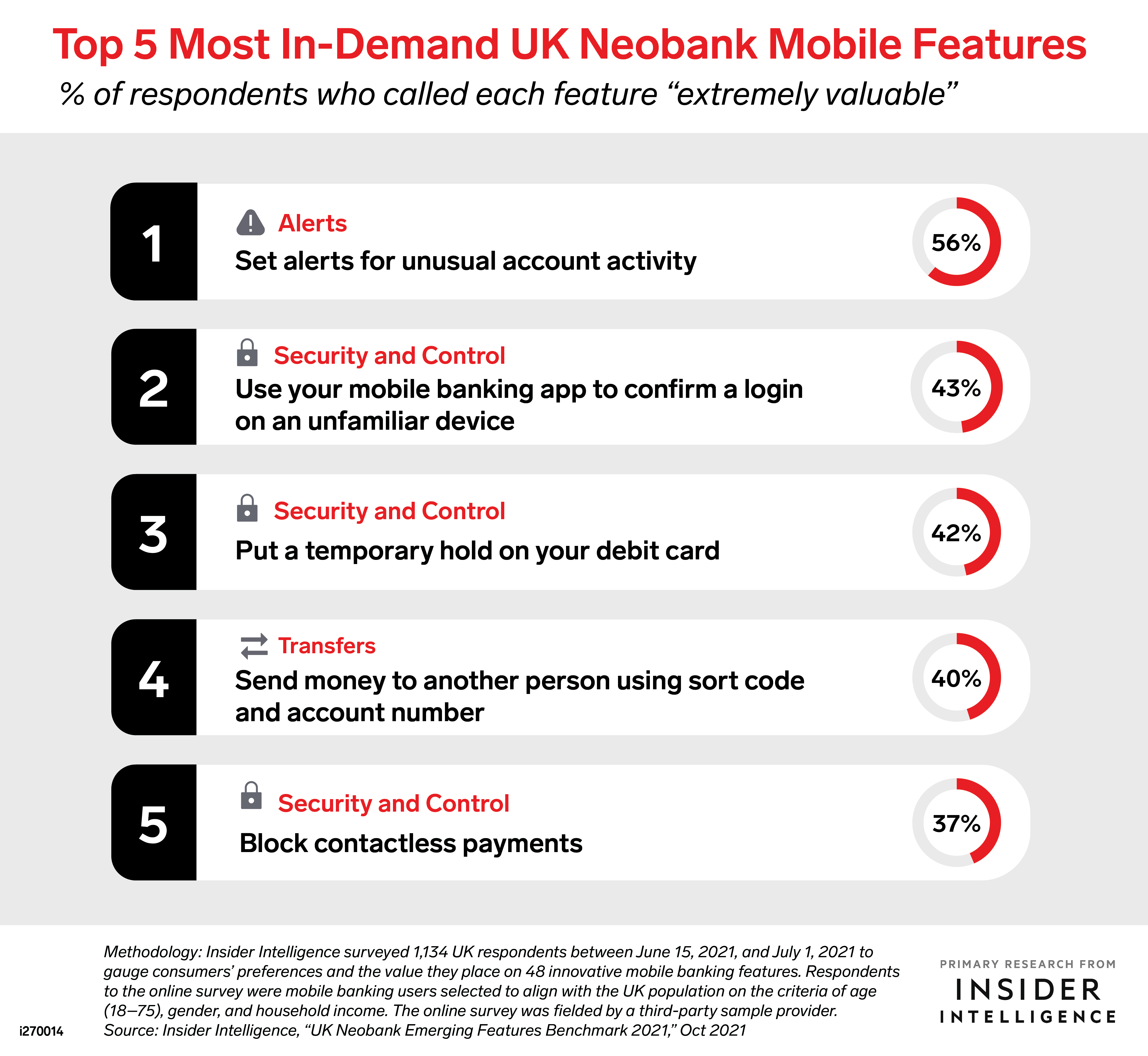

UK Neobank Emerging Features Benchmark 2021 (Insider Intelligence)

Tyler Brown, Lea Nonninger, and Michael Tattersall, analysts at Insider Intelligence, analyze the fact that over the past five years, neobanks have advanced on two fronts: user growth and richness of mobile functionality. But they’re still chasing profitability, launching new financial services offerings and reserving some of their most innovative features for paying customers. This second annual study stacks up the top four UK neobanks against one another, evaluating their mobile app capabilities based on consumer demand for 48 emerging features. Read more.

The Transition to Net-Zero Could Create a £160billion Opportunity for the UK Economy (Fintech Times)

Analyst at Fintech Times highlight a report published by NatWest, which sets out the potential opportunity that exists for the UK economy from the transition to net-zero, finding that SMEs could create up to 130,000 new jobs, produce around 30,000 new businesses and result in an estimated £160billion opportunity for the UK economy. The report finds that there is a significant opportunity for the UK to be a global leader in the transition to net-zero. Read more.

—

Do you have any news to share: please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here: https://hollandfintech.com/featured/newsletters/ . In order to see our other weekly highlights, check out the following links: analysis & opinion.