For this week’s research article, we dive into new insights on decentralized finance, investment, sector overview and DLT. Enjoy researching!

Irish FinTech investment on track to double in 2022 (Fintech Global)

Irish FinTech investment is set to more than double to $854m based on investment in the first half of 2022 and deal activity is expected to reach similar levels to 2021 with a slight 4.5% decrease. Global FinTech investment in Q2 2022 reduced a significant 24% from the first quarter of 2022 although Irish FinTech investment has resisted the global trend and increased by 17%. Read more

Tymit Study Examines Credit Card Use in Post-Covid Travel (The Fintech Times)

In light of two years of travel restrictions, and against the rising cost of living, over 14 million Brits plan to spend more on their holiday this year, with a tendency among younger generations to finance their experience with the use of unsecured credit.

This was the primary finding of a recent survey carried out by the challenger credit provider Tymit, which surveyed 2,000 UK residents on the eve of the holiday season to identify their intended spending habits abroad. According to the findings, 28 per cent plan to spend more on holidays this year, despite the rise in the cost of living. However, 31 per cent intend to finance their travel through the use of credit cards, with younger generations far more likely to finance their travel with unsecured credit. Read more

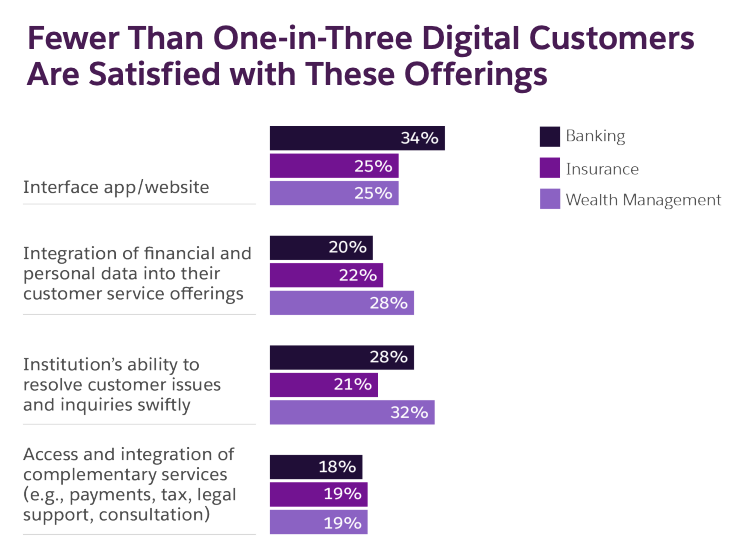

One in Three BFSI Customers Are Underwhelmed By Their Digital Offerings (Fintech Singapore)

Accustomed to the highly personalized digital experiences they get from bigtechs like Google and Amazon, banking and insurance customers are increasingly growing dissatisfied with the services they receive from their traditional financial services providers. This suggests a gap between customers’ expectations and what’s being offered to them, and implies that financial services institutions need to step up their game to meet the expectations of an increasingly digital-first clientele, a Saleforce 2022 survey found. The survey, which polled 2,250 customers in North America, Europe and Asia-Pacific (APAC), found that less than one third of banking, wealth and insurance customers are satisfied with their providers’ digital interfaces, as well as their advice personalization and integration capabilities. Read more

The Future of Digital Banking in the UK: Retaining top digital talent (Finextra)

The “talent drought” has been a key topic of discussion from fintechs and banks alike. As companies become more in need of talent, especially those providing the building blocks for an increasingly digital banking world, it is the problem of these institutions to look at what they are doing to find, keep and benefit from top digital talent. Diversity in all sectors of finance continues to be a problem, leading to companies losing out on sections of talent. Tech Nations’ Diversity in UK Fintech 2021 report found that 20% of people in fintech are Black, Asian, and people of other underrepresented minorities. This is higher than the UK labour market where that figure is 11.8%. While Fintech Diversity Radar’s 2021 diversity report found that of the top 1,000 fintech globally only 16 were founded solely by women. The same report found that just 11.3% of fintech board members of women. Read more

—

Do you have any news to share: please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion