The fintech industry is rapidly evolving and disrupting traditional financial systems. In this article, we bring you the latest research insights to help you stay ahead of the curve and understand the future of financial technology. Enjoy researching!

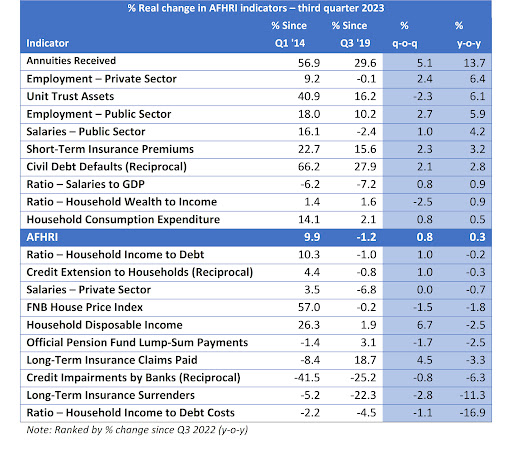

Latest Altron FinTech Household Resilience Index confirms that most South Africans are in a tough financial position (IT Web)

The latest Altron FinTech Household Resilience Index (AFHRI) reveals that South African households are facing severe financial pressure, primarily due to the restrictive monetary policy of the South African Reserve Bank. The ratio between household disposable income and debt costs is identified as the worst-performing indicator. Altron FinTech’s Managing Director, Johan Gellatly, anticipates challenges for retailers in the first quarter of 2024, especially after the December holiday period, when personal credit facilities are often stretched. Economist Dr. Roelof Botha notes a strong correlation between higher interest rates and the AFHRI trend, with the index expected to face challenges in the first half of 2024 despite potential lower interest rates. Read more

Venture Funding to Fintechs Fell by More Than Half in 2023, Plummeting to 6-Year Low. Now What? (Inc.)

Venture capital investments in financial technology (fintech) experienced a significant decline in 2023, dropping over 50% from $89.5 billion in 2022 to $43 billion. This marks the lowest level of funding for the fintech sector in six years. The decrease in funding reflects a broader trend in the startup ecosystem, with overall venture capital investment falling by 38% from $462 billion in 2022 to $285 billion in 2023. The decline in fintech funding is attributed to changing investor sentiments, challenges in achieving growth expectations, and a more crowded and competitive landscape within the industry. Despite the funding slump, fintech entrepreneurs highlight opportunities in sub-genres like wealthtech, insurtech, and regtech, as well as potential for technological innovations supporting capital markets and initiatives like the Federal Reserve’s FedNow program. Read more

Geopolitics and the geometry of global trade (McKinsey & Company)

McKinsey’s massive report highlights a reconfiguration of global trade patterns, with shifts in geopolitical and geographic trade distances. Trade between distant economies contributes significantly to globally concentrated products, comprising almost 20% of global goods trade but nearly 40% of trade in such products. Since 2017, China, Germany, the UK, and the US have reduced their geopolitical trade distances, while ASEAN, Brazil, and India show increased trade across geopolitical spectrums. Greenfield investment has shifted to developing economies, with notable increases in Africa and India. Future trade reconfiguration involves trade-offs, such as reducing geopolitical distance leading to increased trade concentration. Business leaders are advised to navigate uncertainty by gaining insights, scenario planning, strategic actions, and geopolitical awareness. Read more

How global businesses can leverage the ISO 20022 standard to enhance their operations across borders (The Paypers)

How can you use ISO 20022? It is a global message format structure used for payments, offering rich, structured data for consistent messaging. It facilitates interoperability, enhances customer experience, and enables cost reduction for global businesses operating across borders. Leveraging the standard can homogenize data, reduce costs, and provide richer insights into your business. In terms of compliance with anti-money laundering (AML) and know your customer (KYC) regulations, ISO 20022’s enhanced data can augment fraud and AML capabilities, improving monitoring and reducing fraud. This contributes to increased security and trust in global ecommerce transactions. ISO 20022 supports real-time payments, data-rich transactions, and enhances customer experience in cross-border ecommerce by providing instant funds availability, reducing errors, and enabling flexible payment options. The adoption of ISO 20022 is influenced by varying regulatory frameworks in different regions, and organizations need to navigate challenges related to compliance timelines, technology infrastructure, data quality, testing, and employee training to effectively adopt ISO 20022 for global payments. Read more

Is there a need for more regulation within ESG? (Fintech Global)

The importance of Environmental, Social, and Governance (ESG) in business is rising due to customer demands and evolving regulations. The lack of standardization in ESG rules poses challenges globally, as achieving alignment across existing ESG regulations is essential for clarity and impact. As such, efforts like the International Sustainability Standards Board (ISSB) aim to standardize ESG reporting. Increased regulation in ESG is expected, focusing on standardization, reporting, and integration into financial regulations. However, a risk of a tick-box approach and challenges for smaller companies may arise. Over the next five years, regulators are likely to prioritize disclosure and ESG data quality, with global coordination efforts. Industry-specific rules may create disharmony and trade disputes, so global collaboration is crucial for an efficient systemic change toward sustainability. Read more

-

Do you have any news to share? Please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion