For this week’s research article, we dive into new insights on fintech market, banking, insurance, payments, trends, diversity in fintech and more. Happy reading!

Leading Financial Centres Stepping Up Sustainability Action (FC4S)

The fourth annual State of Play report by the UNDP-hosted Financial Centres for Sustainability (FC4S) Network has identified several key areas where more focus is required to underpin progress around the sustainable finance agenda. Overall, the report provides compelling evidence that financial centres’ initiatives were characterised by strong growth, increased scope, greater maturity and accelerated action across 2021. And with this year’s COP27 expected to focus on unlocking further capital in support of the transition, 2022 is shaping up to be an important year for financial centres and their sustainable finance activities. Read more.

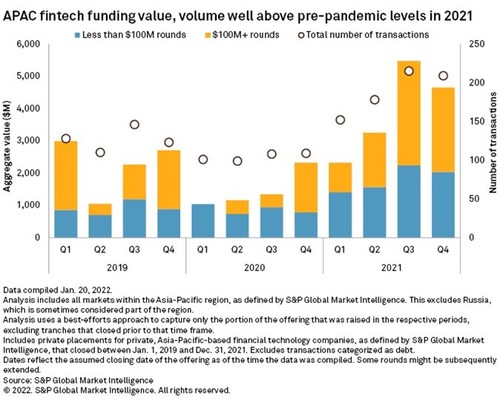

Robust M&A and funding outlook for APAC fintechs despite market volatility says S&P Global Market Intelligence’s 2022 Asia-Pacific Fintech Market Report (PR Newswire)

Looming interest rate hikes could toughen the venture capital environment, but fintechs with strong market positions will likely have no trouble attracting investors, according to the 2022 Asia Pacific (APAC) Fintech Market Report from S&P Global Market Intelligence. The newly released report spotlights key trends in fintech investments, digital payments, and market dynamics between technology players and banks in the APAC region. Read more.

Funding pours into rapidly growing climate fintech scene across Europe and US (Fintech Futures)

Climate fintech start-ups raised $1.2 billion in 2021 – three times more than all previous years combined – according to new figures from fintech-focused VC firm CommerzVentures. The CommerzVentures Climate FinTech Report 2022 revealed that US companies were higher funded on average than European ones, particularly at Series B-level or after, where US firms raised $403 million against the EU’s $239 million. However, EU climate fintech companies raised more in total at pre-seed, seed and Series A level. Read more.

FinTech Scotland has Unveiled its Research and Innovation Roadmap (Digit FYI)

The 10 year roadmap aims to drive a threefold increase in economic growth and job creation. FinTech Scotland has published a Research and Innovation (R&I) Roadmap with the objective of boosting economic recovery, driving growth and creating jobs over the next ten years. Over this period, the roadmap lays out a goal to deliver in an additional 20,000 plus fintech related jobs as well as produce an increase in economic gross value add (GVA) through fintech innovation from £0.5bn GVA today to £2.1bn GVA by 2031. Read more.

Move Over ‘Tech Bros’: Women Entrepreneurs Join Africa’s Fintech Boom (Real - Leaders)

Female ‘techpreneurs’ are taking their place in Africa’s male-dominated fintech boom, but gender bias makes it harder for them to access finance and grow their businesses. When financial analyst Oluwatosin Olaseinde moved back home to Nigeria in 2013 after a decade studying and working abroad, she decided it was time to tackle her own finances, so started reading up on stocks and mutual funds. Shocked at how little guidance was available for young professionals like herself, Olaseinde began sharing her learnings in fun, bite-sized tutorials on Instagram, and much to her surprise, her posts went viral. Read more.

—

Do you have any news to share: please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here.

In order to see our other weekly highlights, check out the following links: analysis & opinion.